Money Supply Growth Accelerates, Credit to Private Sector Still in Decline

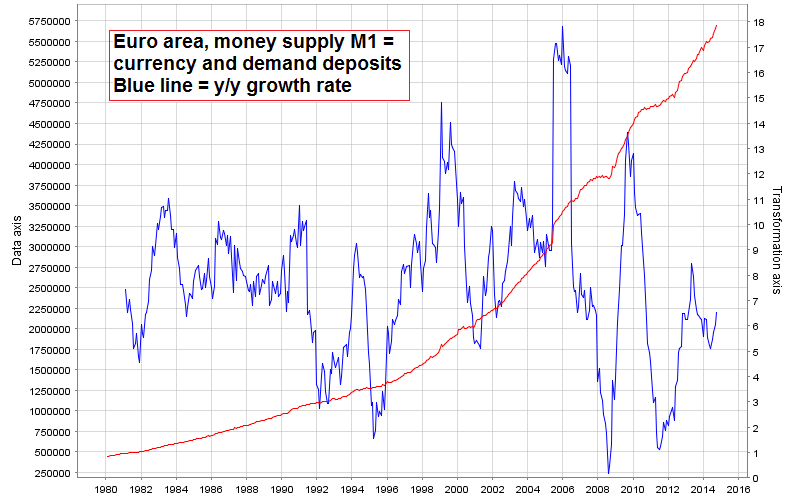

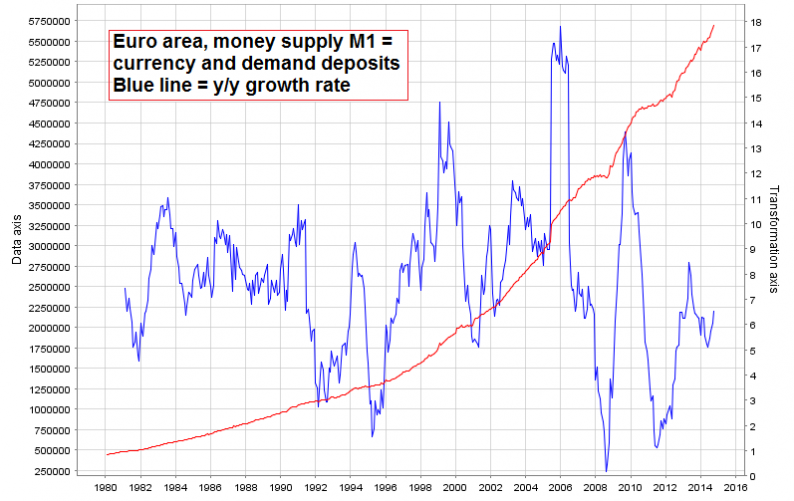

While money supply growth is slowing down in the US, it has recently continued to accelerate somewhat in the euro area. The effects of the ECB’s “QE”-type debt monetization activities in the form of covered bond and ABS purchases have not yet impacted aggregate money supply data much as of yet, but the 12-month growth rate of the narrow money supply aggregate M1 (currency and demand deposits, essentially equivalent to money TMS-1) has nevertheless continued to increase:

The 12-month growth rate of the euro area’s money supply supply has recently accelerated from an interim low of 5% to approx. 6.5% – click to enlarge.

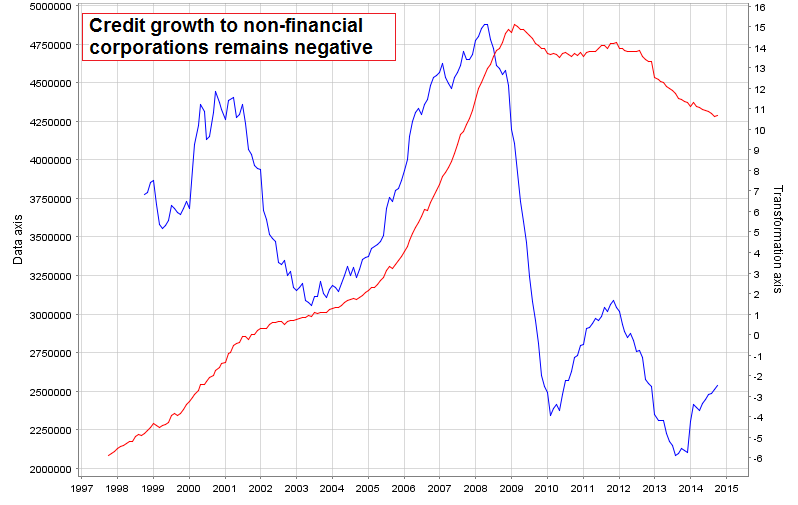

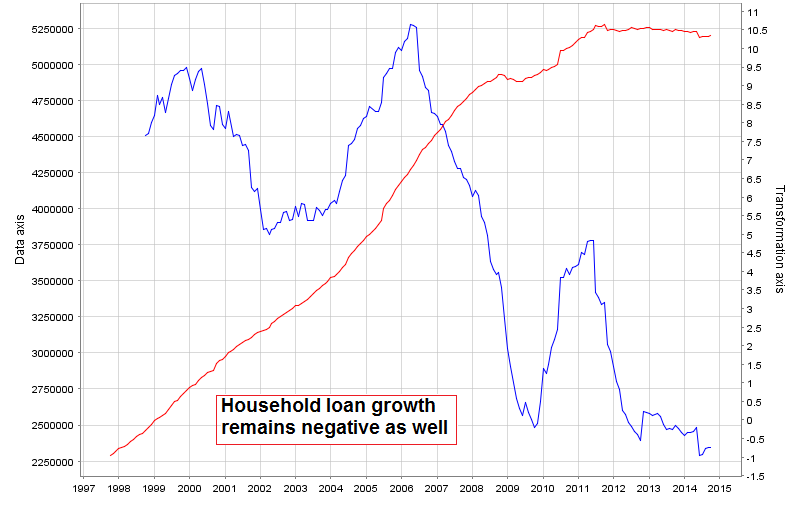

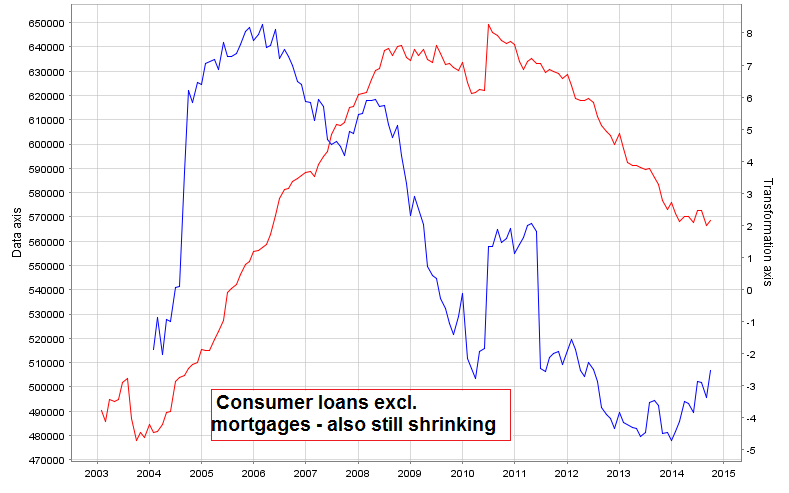

Meanwhile, bank credit growth to the private sector continues to be conspicuous by its absence, at least in terms of the aggregate data for the euro area (there are obviously differences between various member states). Below are charts showing loans to non-financial corporations, loans to households (and non-profits serving households), and consumer loans excluding mortgages. As in the chart of M1 above, the red lines show the total stock outstanding, while the blue lines indicate the year-on-year growth rate.

Loans to euro area non-financial corporations – still sporting a negative y/y growth rate – click to enlarge.

Loans to households in the euro area are still shrinking as well – click to enlarge.

Loans for consumption (excl. mortgage lending) – similar to corporate lending, the pace of the year-on-year decline is slowing, but the growth rate remains in negative territory thus far – click to enlarge.

Conclusion:

Given that credit growth in the private sector remains negative, the acceleration in money supply growth must be tied to banks monetizing government debt and the ECB’s pumping efforts. A growing money supply provides the fuel for asset bubbles and capital misallocation, but it isn’t going to “fix” what ails the economy. There is still a lot of talk about economic reform in Europe, but very little action. In fact, a number of countries have even regressed and backtracked on previous reform efforts (such as e.g. Germany, which has recently introduced a minimum wage, in spite of the fact that everybody is apparently aware that it will increase unemployment and raise consumer prices). Others like e.g. France and Italy, are all hat and no cattle as they would say in Texas. While the need for profound reform is acknowledged, it somehow never seems to actually happen.

Leave A Comment