The common currency Euro came under renewed pressure following the earlier release of preliminary inflation data for the Eurozone. According to Eurostat, core CPI fell to 0.7% in February against expectations of a slight decline to 0.9% from 1.0%. Core inflation strips out highly volatile components such as energy and food prices. Though preliminary, the figures will put additional pressure on Mario Draghi and the European Central Bank when they meet next week. The only event that might offer some hope is the upcoming release of growth data for the Eurozone which is due out just ahead of the rate decision.

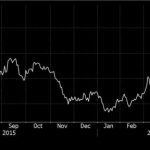

As reported at 10:54 am (GMT) in London, the EUR/USD was trading lower at $1.0906, down 0.23%. In today’s session, the pair has ranged from a trough of $1.0895 to a peak of $1.0965. The EUR/GBP was also lower at 0.7872 Pence, down 0.18%; the pair’s trading range for today included a low of 0.7858 Pence and a high of 0.7898 Pence.

ECB Options Dwindling

The ongoing saga of a possible “Brexit,” i.e. the withdrawal of Britain from the European Union, is also weighing on the Euro. Many believe that Mario Draghi has very little left in his arsenal except to further tread into negative territory as regards deposit rates. That would encourage European banks to park their overnight money in the Eurozone’s private banking system rather than with the ECB where they’d be charged a “penalty” for the privilege.

Leave A Comment