The Gift that Likely Will Keep Giving …

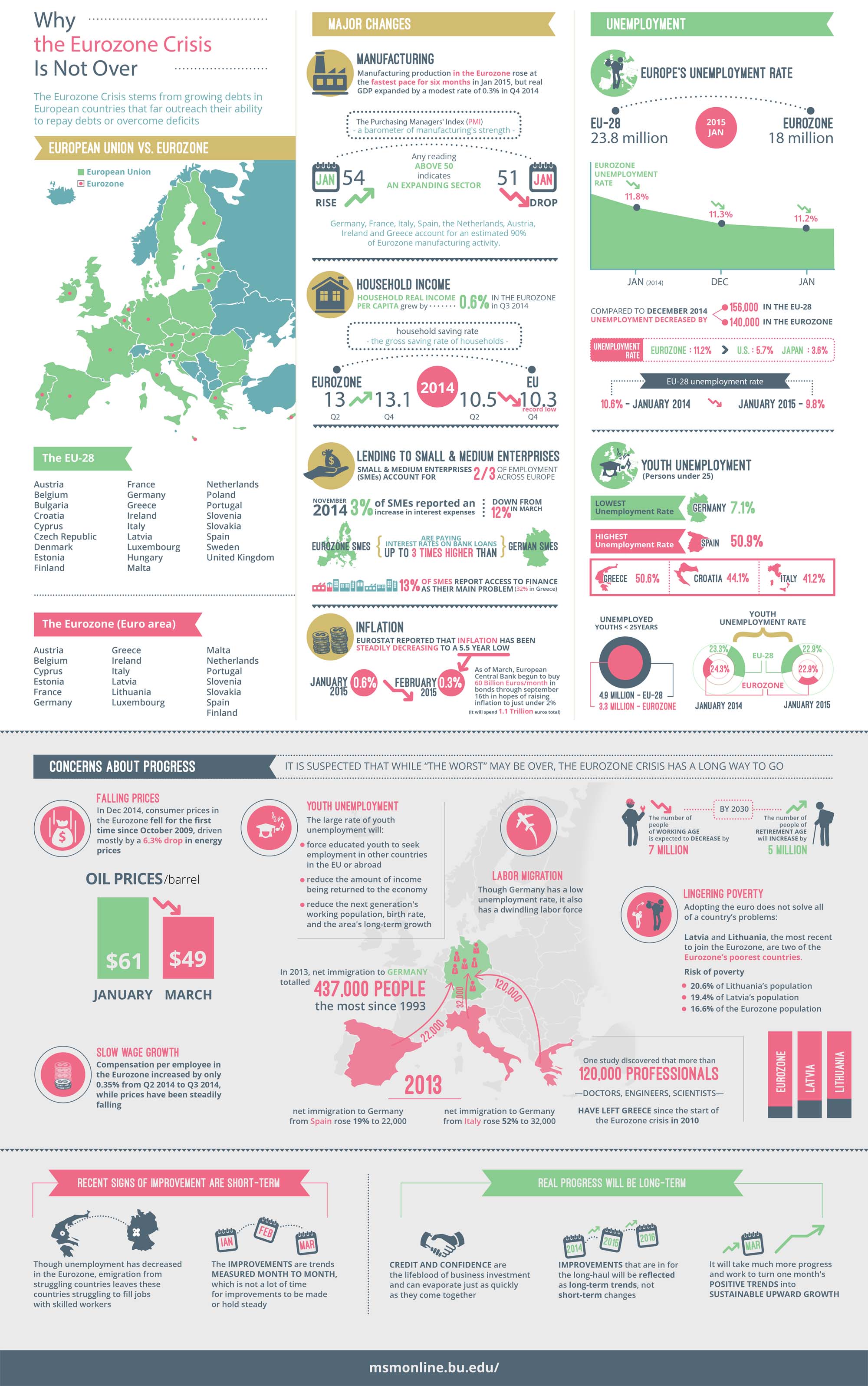

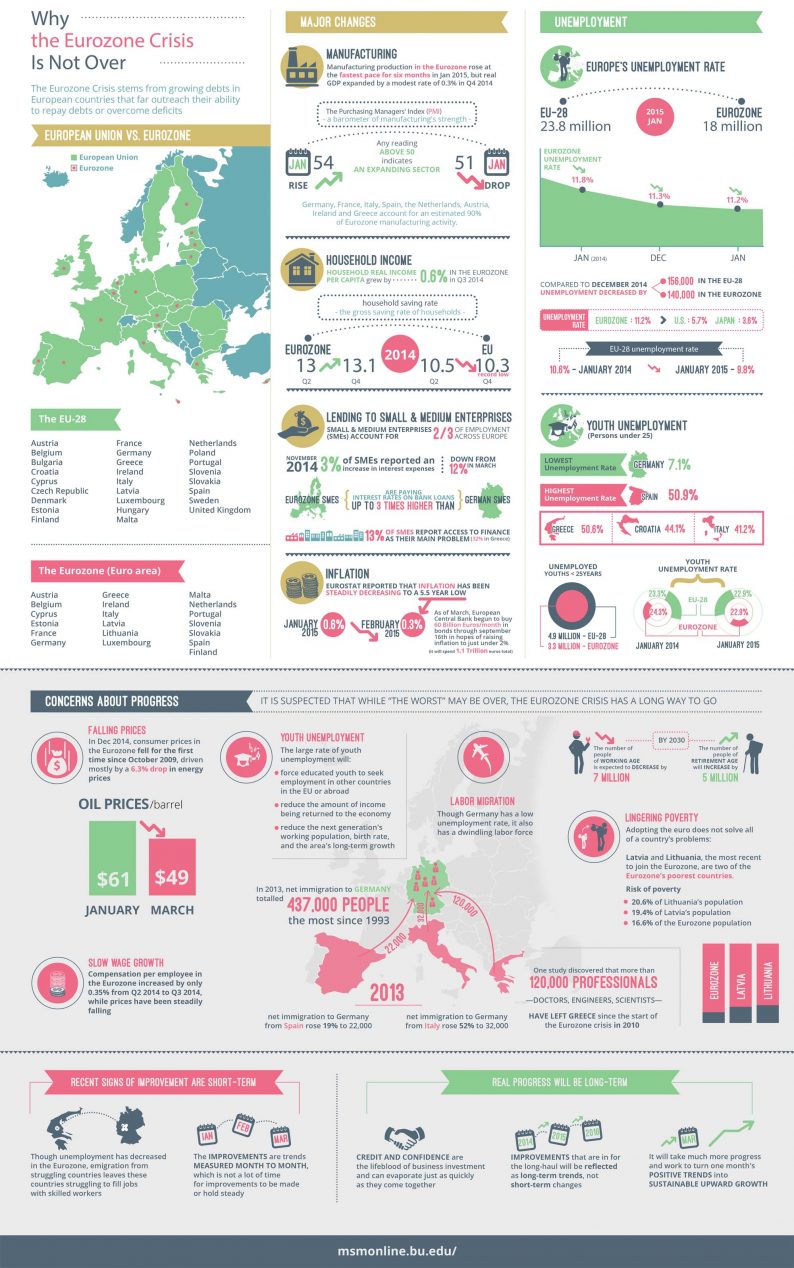

Jay Taylor has mailed us an infographic he and his colleagues at Boston University and Pearson Education have put together, entitled “Why the Euro Zone Crisis is not Over”. We have decided to reproduce it here, as it provides a good overview of the most important data points surrounding the still festering crisis situation.

Click on picture to enlarge

Infographic by Boston University and Pearson Education

Why even talk about the “long forgotten” EZ crisis at this juncture? It could well be that it makes another entrance from stage left when least expected. When markets become as unruly as they recently have, one needs to cast one’s gaze around so as to take in all potential flashpoints that might contribute to a “perfect storm” in the future. The no longer much talked about EZ crisis is one of those, as the fundamental problems that caused the crisis in the first place remain unsolved.

Conclusion

The euro zone crisis has calmed down due to a flood of newly printed money provided by the ECB. At some point the money printing will have to end though, and the economy will find itself with even more malinvested capital and debt. What then? The Keynesian spaceship metaphor (the notion that the economy will miraculously reach the magical threshold known as “escape velocity”) is largely a figment of the imagination. An economy that is kept on artificial life support with money printing will simply relapse into recession when the money printing ends.

Leave A Comment