New Age monetary policy has begun to resemble the form of insanity in which a patient repeats the same behavior while expecting a different outcome.

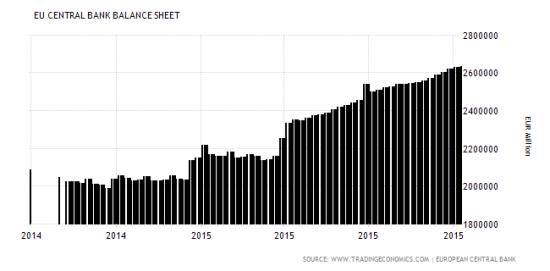

Throughout the developed world, interest rates are at record lows and central banks continue to pump out newly-created currency. Yet growth remains tepid, inflation is nonexistent and debt of every type continues to mount. And instead of recognizing that somewhere in their guiding theory lurks a fatal flaw, governments and central banks just keep upping the ante. Today it was Europe, where central banks have been expanding their balance sheets (i.e. running the printing presses) aggressively…

…and forcing down interest rates…

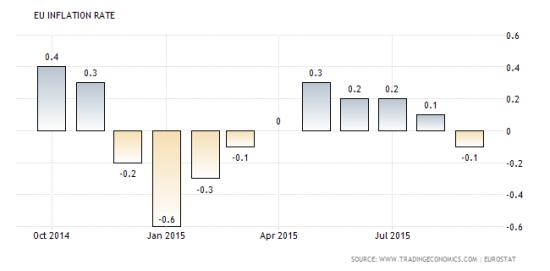

…to no avail. Europe’s inflation rate has been falling all year…

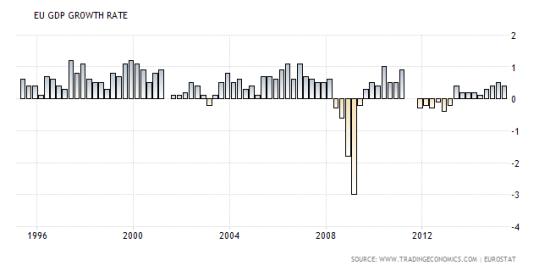

… and GDP growth remains below 1% annualized. That’s nowhere near fast enough to keep up with the accumulation of government debt and unfunded liabilities. The hole in which the EU found itself during the Great Recession keeps getting deeper despite ZIRP and QE.

So what does the European Central Bank do? It promises even easier money:

Mario Draghi: ECB prepared to cut interest rates and expand QE

(Guardian) – Mario Draghi, the president of the European Central Bank, has stunned markets by signalling that he is prepared to cut interest rates and step up quantitative easing to stave off the risk of a renewed economic slump in the eurozone.

The value of the single currency dropped sharply on foreign exchanges on Thursday as Draghi announced that the ECB’s governing council had discussed expanding its €1.1tn (£795bn) bond-buying programme and cutting the rate on reserves held at the central bank.

This “discount rate” is already negative, at -0.2%, meaning banks effectively have to pay the ECB for holding their reserves – a measure aimed at keeping money flowing around the economy.

Speaking after the ECB’s latest policy meeting in Malta, Draghi revealed that some members of the governing council had favoured taking more action to stimulate the economy immediately. He blamed the slowdown in emerging markets, including China, for renewed weakness in the eurozone.

“While euro area domestic demand remains resilient, concerns over growth prospects in emerging markets and possible repercussions for the economy from developments in financial and commodity markets continue to signal downside risks to the outlook for growth and inflation,” he said in his opening statement.

Draghi said the ECB could also step up the scale of QE. A decision is likely to be made at the December meeting of its governing council, when its latest economic forecasts will be available. As Draghi spoke, the euro dropped by 1.5 cents against the dollar, to $1.117.

“The governing council is willing and able to act by using all the instruments available within its mandate, if warranted, in order to maintain an appropriate degree of monetary accommodation,” Draghi said.

Leave A Comment