There was an interesting article written recently by Barry Ritholtz who says that people are feeling cautious towards the market, so they are looking for technical reasons to support their caution. I kind of agreed with the article, but some of the market caution seems reasonable to me.

For instance, John Murphy mentioned in his most recent article that we haven’t had a 5% correction in a really long time, and that we are overdue to have one. He showed this chart below as evidence. I don’t think this is an example of someone looking for a reason to be cautious.

Murphy also mentioned that late summer is often when the market experiences corrections, and we are about a month away from late summer. I can’t argue with that.

I want to avoid a cautious bias so maybe it is a good time to be using the 50-day average. That way I can avoid my bias, and just let the market make the buy/sell decisions for me.

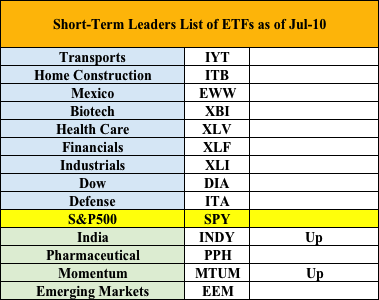

The Leader List

India and Momentum stocks are back in the leader list.

Strong today were Emerging Markets and Materials. Weak were Consumer and Retail.

Europe stocks (VGK) look interesting to me. If the general market holds up, then this price pattern could be a new bullish base forming.

Outlook

The long-term outlook is positive.

The medium-term trend is down.

The short-term trend is down.

Leave A Comment