“Whatever it takes” may not be enough to save this..

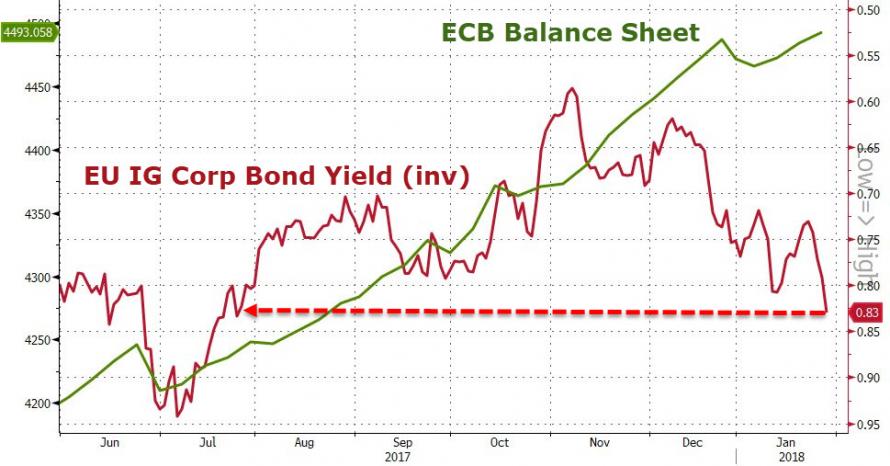

Despite the ongoing money-printing and delusion of ECB bond purchases, European credit markets are crashing.

Investment-Grade European corporate bond yields spiked to 6-month highs today – diverging notably from the flow of central bank buying…

And as credit weakens so stocks tumbled most in over 6 weeks…

Which sent Europe’s VIX surging…

But US VIX is back above EU VIX – by the most since August 2015’s China-Deval flash crash…

Leave A Comment