This is how DB’s Jim Reid previews today’s “extraordinary” announcement from the ECB:

Let’s be honest. Even if you feel like you’ve navigated these treacherous financial markets well over the last decade, could you have really envisaged a day like today if you go back a few years? We stand on the brink of another extraordinary central bank policy easing today (from the ECB of course) which has been increasingly priced into markets meaning amongst other things that you have to pay heavily indebted governments even more for the right to lend to them at the front end of the curve. Indeed Germany has negative yields out to 7 years at the moment. We’re all getting used to it now and generally accept it but one day we’ll probably look back on this period and gasp in amazement that investors were happy to pay to lend/store a few trillion euros here and there.

One day, yes, but for now it is all great news, and sure enough yesterday’s market swoon which unwound all of Tuesday’s gains on concerns about a hawkish Fed and fears about terrorism in the US, are now completely forgotten, and have been replaced with the latest daily round of pre-ECB euphoria, driven by hopes that Mario Draghi will announce even more dovish details to Europe’s Q€ 2 than just a 10 bps rate cut and a boost to QE more than €10 billion, both of which have been already priced in.

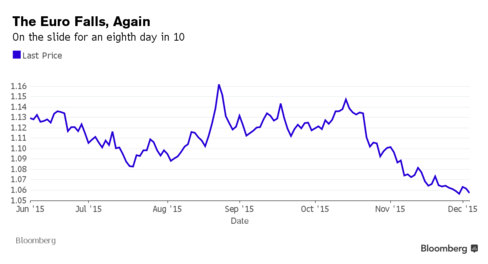

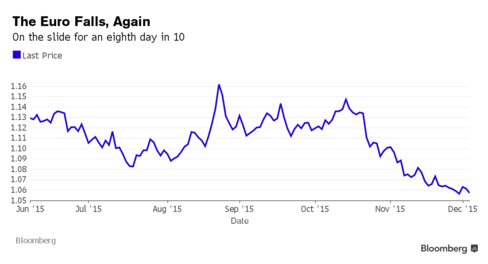

As Bloomberg notes, it’s been 42 days since ECB President Mario Draghi signaled in Malta that more stimulus would be needed in December to counter barely existent inflation. Now it’s down to the details. And while we wait for the rate cut announcement first in just over an hour, and then Draghi’s press conference laying out the details of the QE boost, the euro is hovering above its lowest level since April. Since the ECB last met on Oct. 22 the common currency has sunk almost 5 percent against the dollar.

Also expecting a very dovish ECB is the German 2 Year note, whose yield just dropped to a fresh record low of -0.4532%, having plunged by over 20 bps since Draghi’s last appearance in late October. Currently the ECB is unable to buy bonds yielding less than its deposit rate of minus 0.2 percent, leading investors to price in a cut today to at least minus 0.3 percent.

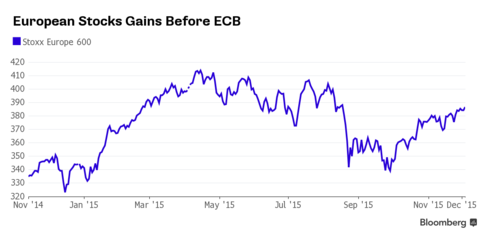

And while there is a very distinct chance that Mario Draghi may disappoint today as Market News warned yesterday, European stocks are not worried, and gain for the first day in three. The Stoxx Europe 600 Index has jumped almost 6 percent since the October meeting. In fact, European stock markets are some of the world’s best performers in 2015. France’s CAC 40 has jumped 15 percent, Italy’s FTSE MIB has surged 19 percent and Germany’s DAX is up 14 percent, entirely due to the ECB’s QE. In comparison, the S&P 500 Index is up 1 percent.

Draghi isn’t the only central bank chief in the spotlight. Federal Reserve Chair Janet Yellen appears before the congressional Joint Economic Committee a day after she said she’s confident in the outlook for U.S. economic growth, paving the way for a policy shift on Dec.16.

Adding to the overnight drama was more headline head fakes from various OPEC leakers, in a rerun of yesterday, when first Energy Intelligence reported that despite prior denials, the Saudis would proceed with a 1 million barrel cut:

… only for the rumor to be denied once again just like yesterday:

The price of crude promptly spiked then swooned lower but the critical level of $40 was again defended courtesy of jittery headline scanning, and all too stupid, algos.

As a result of all these developments, this is where global markets currently stand.

Looking at global markets, Asian stocks traded mostly lower following losses seen on Wall St. amid a slump in the commodities complex which saw crude briefly fall below USD 40/bbl, while gold, silver and platinum fell to 5yr, 6yr and 7yr lows respectively. Consequently, ASX 200 (-0.6%) underperformed led lower by basic materials and energy sectors, while the Nikkei 225 (0.0%) was initially pressured by losses in its largest weighted stock Fast Retailing after domestic sales fell 8.9% Y/Y but later pared as the JPY weakened. Shanghai Comp. (+1.4%) extended on yesterday’s gains led higher again by financials following yesterday’s relaxation on bond issuance rules coupled with a CNY 50bIn injection into the interbank market. 10yr JGBs traded marginally higher in subdued trade as the weakness of Asian bourses supported the paper.

Top Asia News

Leave A Comment