Global markets were oddly calm on Friday, the last day of trading before the first round of France’s closely fought presidential election, with European stocks posting modest declines ahead of Sunday’s main event, Asian shares rising, and set for first weekly gain in the past month, while U.S. futures were unchanged. French bond yields hit three-months low even as the euro has seen some recent weakness.

The long awaited French Presidential Election is now nearly upon us with the first round taking place this Sunday. We’ll likely get exit polls soon after polls close at 7pm local time (8pm BST) with any delays caused by the fact that a few stations are open for an extra hour. In terms of the how the polls are looking, yesterday there was a lot of focus on a Harris poll which showed that support for Macron was running at 24.5% in the first round (compared to 23% ish in other polls) and support for Le Pen is at 21% (versus 22-23% in other polls). Melenchon and Fillon came in with support at 19% and 20% respectively. French assets had a strong day yesterday and outperformed other European assets on the back of that Harris poll. The CAC closed +1.48% for its best day since March 1st. That compared to a much smaller +0.22% gain for the Stoxx 600.

Trading along with the latest polls, the euro has shown little signs of anxiety days before the crucial vote as Le Pen has fallen behind centrist Emmanuel Macron in recent polls.

The fatal attack on a police officer in Paris overnight caused investors some immediate jitters, with the gap between French and German 10-year borrowing costs rising sharply in the first few minutes of trading. Traders said this was on concern the attack could sway the vote in favor of Marine Le Pen. But that move reversed as the session wore on, with the yield on 10-year French government debt hitting its weakest since mid-January and the gap between it and its German equivalent falling to its tightest in three weeks. The stated reason for the move back was that the market assumed any gains for Le Pen would come at the expense of Melenchon.

The murder of a policeman on the Champs-Elysees also forced an early end to campaigning ahead of Sunday’s vote in France. Investors are bracing for a period of uncertainty until a victor emerges on May 7.

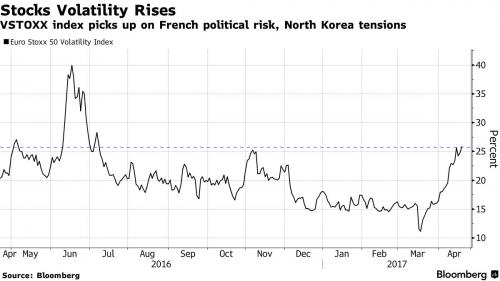

“The need to hedge the downside risks on the euro without capping the upside potential, has mostly pushed investors toward the currency options through the week,” Ipek Ozkardeskaya, a market analyst at London Capital Group wrote in a note. Heightened stock volatility has been spurred by investors’ need to protect against political risk into and following the first round, she said.

Despite Friday’s seeming calm, in recent weeks European stock volatility has seen a pick up, rising to the highest level since Brexit last summer.

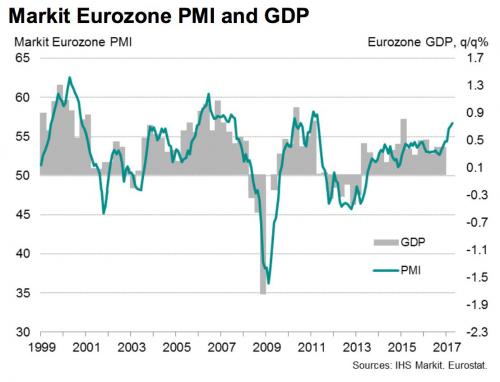

Away from the French elections, Europe had something to cheer about with a slew of upbeat PMI reports this morning suggesting a pick up in the economy across the Eurozone. According to Markit, Eurozone PMI hit a 6 year high in April, suggesting the reflation trade is alive and well in Europe, which continues to shrug off any political uncertainties, and continues to be a headache for Mario Draghi who needs some justification to keep extra easy monetary conditions.

There was some less attractive data out of the UK, where the big data release was the March UK retail sales release, which posted the worst Q1 data since 2010, although there was little follow through in GBP selling as Cable buyers stood resolute ahead of 1.2750 and EUR/GBP buyers will find little reprieve ahead of the French elections this weekend.

Futures on the S&P 500 rose 0.1 percent as of 6:20 a.m. in New York. The cash index rose 0.8 percent Thursday, with American Express surging nearly 6 percent to pace gains in the financial group after its results topped estimates. European stocks were little changed, with the STOXX 600 index up 0.01% at 6:40am ET.

“So far markets have been pretty sanguine in the face of the (French) presidential election, which was flagged as one of the potential banana skins for markets in this year and I think that may be partly a result of political fatigue,” said Hargreaves Lansdown analyst Laith Khalaf, in London. But options markets suggested investors remain worried about strong results for Le Pen and/or hard-left challenger anti-EU Jean-Luc Melenchon that would point to the risk of another major political shock for Europe in two weeks time.

“It is kind of reminiscent of the big events last year where people know that it is a binary outcome so the best approach is to remain as cautious as possible,” said Simon Derrick, head of the global markets research team at Bank of New York Mellon in London. France’s CAC stock index fell 0.9%, though it was only around 2 percent off its highest levels since mid-2015.

French 10-year yields fell two basis points to 0.92 percent. Bunds also gained, with the yield on the benchmark due in a decade one basis point lower at 0.24 percent. U.S. government debt fell, as the yield on the 10-year note rose one basis point to 2.24 percent, climbing for a third straight day.

In Asia stocks ended the week on a positive note, unscathed by a U.S. trade probe on Chinese steel exports. MSCI’s broadest index of Asia-Pacific shares outside Japan added 0.5 percent, but was down 0.4 percent on the week. Asian steelmakers were mostly steady or higher, as investors dismissed for now any negative impact from the launch of a U.S. trade probe against Chinese steel exporters, although Chinese companies shed some of their earlier gains. The move sent their U.S. counterparts surging over 8 percent overnight. Japan’s Nikkei advanced 1 percent, posting a weekly gain of 1.6 percent. Chinese shares in Shanghai added 0.1 percent but recorded a 2.2 percent weekly drop, their worst since mid-December.

Leave A Comment