As I wrote yesterday, the eurozone is fully recovered from the sovereign debt crisis. And that’s been true since early in 2016. But it’s only now that big growth is kicking into high gear as the synchronized global upturn takes hold.

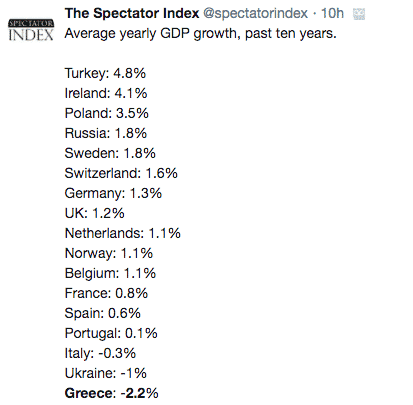

These are statistics though — averages. Underneath the surface, there’s still a lot of pain in Europe, perhaps even more than in the US. Take this chart on 10-year growth trajectories, for example.

This is average growth over a decade – and Greece is at -2.2%. That’s a Great Depression, folks. Sure, Greece is going to grow in 2018, but it’s projected to be less than 2% — near the bottom of EU growth projections.

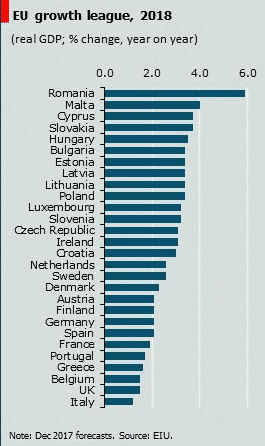

Source: The Economist

When it comes to the Eurozone, I think it’s fair to say, Greece is far and away the loser.

What about winners? A lot of people point to Germany, but Ireland has a higher growth rate than Germany does over the last 10 years. And a lot of countries in the Eurozone are expected to grow more than Germany in 2018.

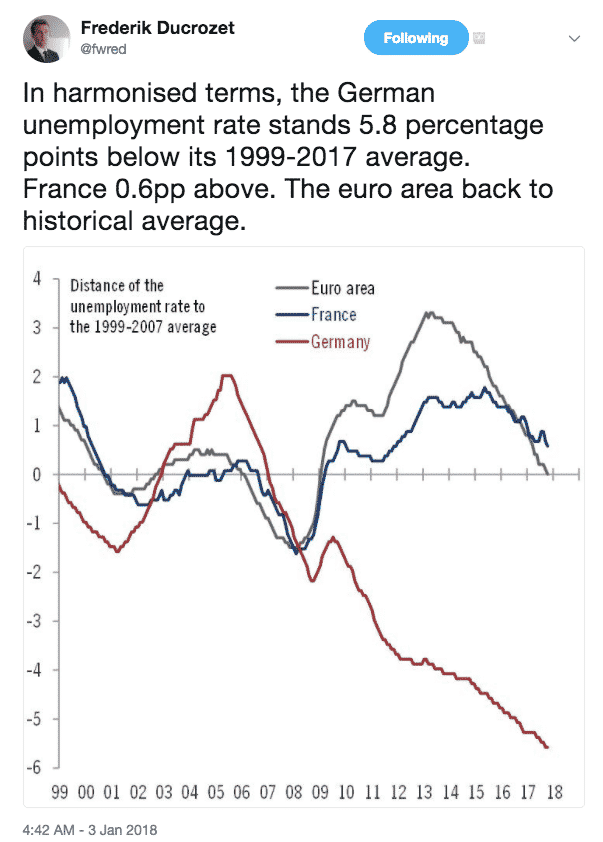

But, let’s remember that Germany was in what I have called a ‘Soft Depression’ before the Euro was formed. Look at Germany now.

That’s some serious outperformance on the employment side.

Bottom line: Despite the EU being statistically fully recovered from crisis, not everyone has benefitted. Greece, for one, is still in a world of hurt. Unemployment is still 20%. And Greece’s economy is now one quarter smaller than it was a decade ago. They are a clear loser. Another loser from the Euro I haven’t mentioned, if you look at the charts above, is Italy. -0.3% growth over a decade and still at the bottom of growth estimates for this year too. Germany is the big winner. Yes, growth in Germany is not tops in Euroland. Still, unemployment is now at a record post-reunification low. And the economy is booming, whereas pre-Euro Germany was the sick man of Europe.

Leave A Comment