The euro continues to be on a tear as ECB is clearly moving towards a taper sooner rather than later. Although ECB officials continue to warn that inflation is still subdued, they clearly see that the EZ economy is recovering and will likely provide guidance about beginning to tighten QE relatively soon.

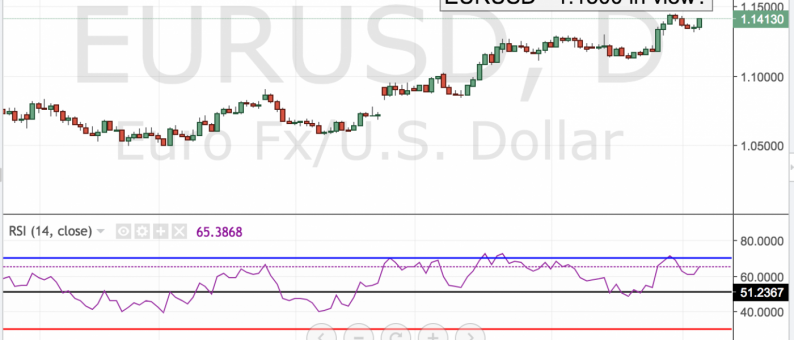

The EURUSD, as a result, has shot higher despite the fact that US monetary policy makers also have a hawkish bias. At this point, the trade is in relative expectations. German Bund yields today hit a 1.5 year high and the yield differential between US rates and German rates continues to compress.

Tomorrow NFPs could trip euro longs, but only if the number shows blow out strength. Otherwise, the pair could shrug off any knee jerk reaction and if the numbers actually miss the forecast euro longs will no doubt press for the 1.1500 target as the day proceeds.

Leave A Comment