Previous:

On Wednesday the 13th of December, trading on the euro/dollar pair closed 80 pips up. The single currency initially rose against the dollar from 1.1730 to 1.1771 (+41) after consumer inflation data in the US was published and then rose from 1.1771 to 1.1826 (+55) after the FOMC meeting.

The FOMC meeting culminated in the decision to raise interest rates again by 25 base points. The federal funds rate now ranges from 1.25% to 1.50%.

The Fed is planning 3 rate hikes in 2018 and has expressed concerns over slowing inflation in the US. As Janet Yellen said, “our understanding of the forces driving inflation isn’t perfect”.

Since the current rate hike and a further three planned for 2018 are now built into the market price, traders are selling dollars en masse.

Day’s news (GMT+3):

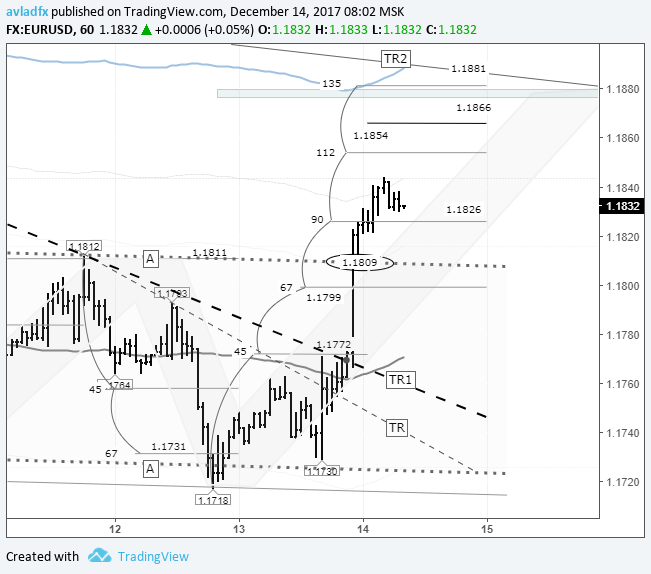

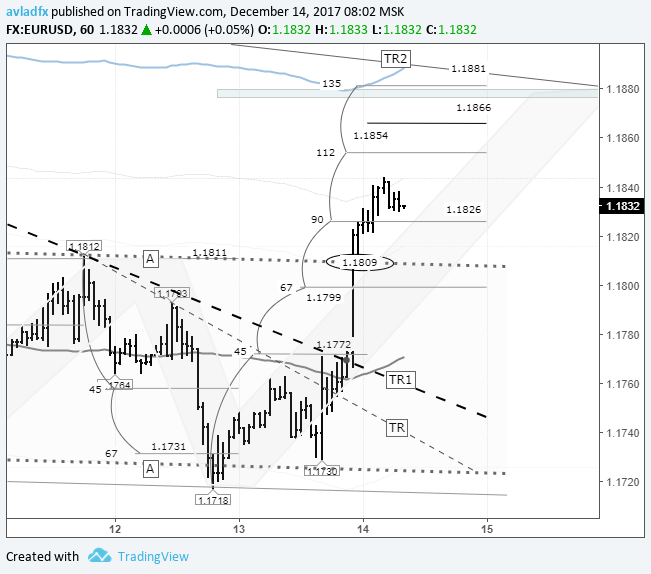

Fig 1. EURUSD hourly chart. Source: TradingView

Wednesday turned out to be very volatile for global markets. The dollar retreated on all fronts. By the time the US session opened, the euro had dropped to 1.1730. Market participants were jittery ahead of the FOMC meeting.

After consumer inflation data was published, the first major wave of dollar sales took place. The FOMC meeting and Janet Yellen’s speech led to even more sales. In the US session, the euro recovered to 1.1826. In Asia, the pair has reached the 1.1844 mark.

Leave A Comment