Previous:

On Friday the 16th of March, trading on the euro/dollar pair closed down. After recovering to 1.2336, the pair dropped by 76 pips to reach 1.2260. This was brought about by positive US data, which provided support to the US dollar.

The industrial production and Michigan consumer sentiment indices exceeded expectations. Markets ignored the housing data. US10Y bond yields jumped from 2.81 to 2.859% on this news.

US data:

Day’s news (GMT+3):

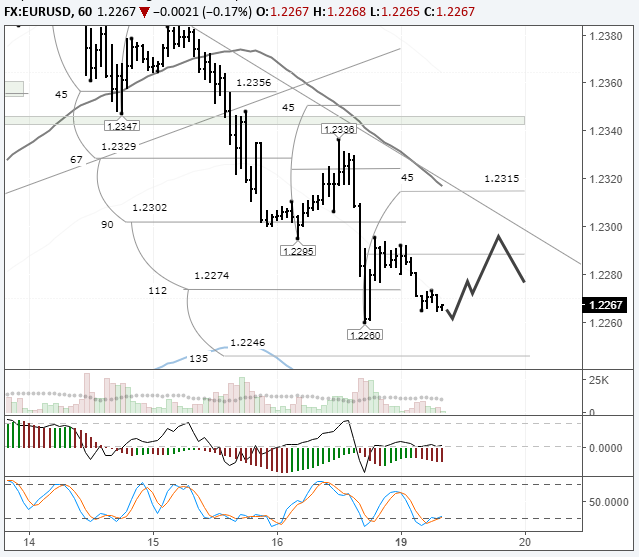

Fig 1. EURUSD hourly chart. Source: TradingView

My expectations for Friday worked out perfectly. The pair underwent an upwards correction before dropping to the 112th degree. The correction went higher than the 22nd degree with help from the euro crosses. The breakout of this level, however, is insignificant. Buyers didn’t even make it to the trend line.

Monday’s economic calendar is bare. Trader attention will be focused on the outcome of the FOMC meeting, which starts on Tuesday. A key rate hike of 0.25% has already been factored into the price by markets. So, after the decision is made and a press conference held, we could see the dollar slide.

Today, my forecast is looking at sideways movements within Friday’s range. My scenario of a price recovery to 1.2297 – 1.2305 will remain in place even if the pair drops as far as the 135th degree at 1.2246. The zone between the 112th and 135th degrees is a strong support, so I’m expecting an upwards correction because of this. After the correction, I expect to see a new low.

Leave A Comment