Today’s ECB meeting faked traders out. The text of the statement was decidedly hawkish but the presser stressed the fact that ECB was concerned about low inflation, protectionist policies and only modestly bullish on growth.

The net takeaway from today’s event is that ECB is likely to taper in September, but will remain neutral for quite some time after that. The realization that ECB is still far away from normalization sent EURUSD tumbling more than 100 points off its session highs.

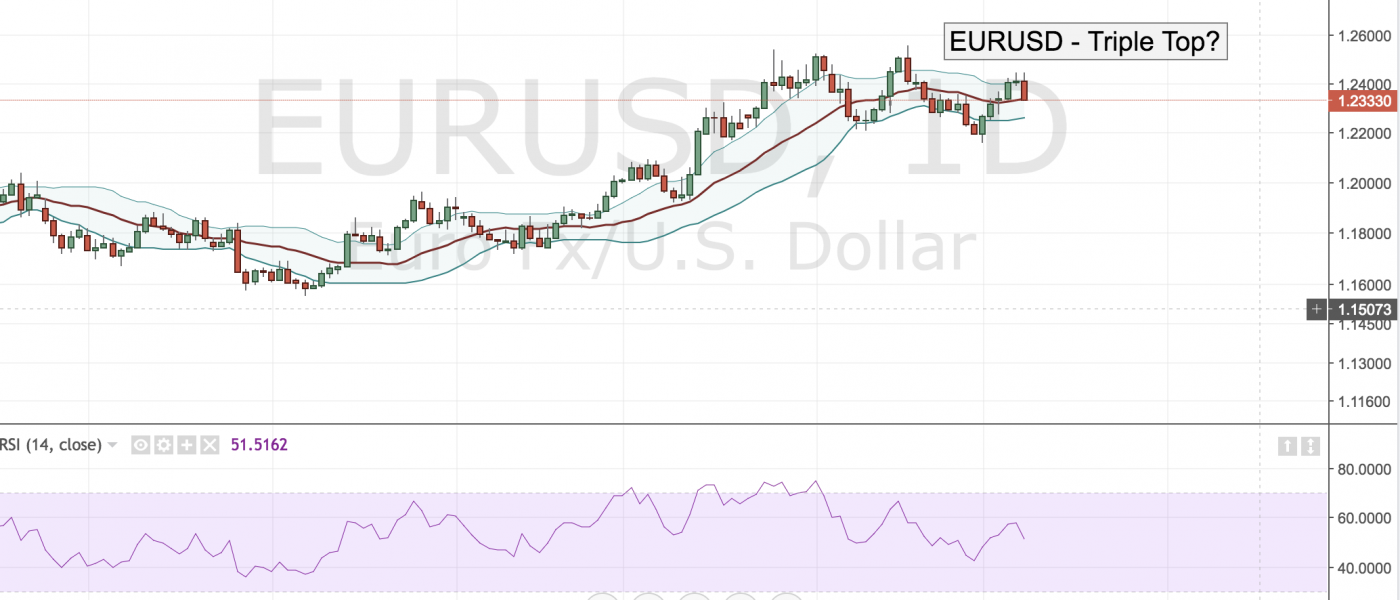

The pair now finds itself carving out a clear triple top at the 1.2500 level and if tomorrow’s NFPs print to the upside could tumble towards 1.2200 over the next few sessions.

Leave A Comment