After the Cleveland Fed’s warning of “significant stress” in the financial markets, we find none other than Dovish-hawk Jim Bullard’s St. Louis Fed growing increasingly fearful of the “r” word.

the Cleveland Fed’s warning of “significant stress” in the financial markets the Fed unleashed QE1 and Operation Twist…

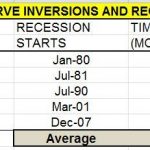

And now, as Mises Institute’s Mark Thornton notes, this little known chart (below) is the St. Louis Fed’s attempt to anticipate a recession in the US economy.

The latest reading from last November is higher than all but 3 months (in the last 50 years) when a recession did not immediately proceed.

As you can see by the chart, there were false starts in early 1978 and 1979 prior to the recessions of 1980 and 1981/82. As well as a false start in September of 2005.

We will see if this time is different…

According to the Fed’s website (FRED):

Smoothed recession probabilities for the United States are obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales.

Given the broadness of the data used to create this indicator, we can’t help but wonder – if the “recession risk” was this high in November, why did The Fed hike rates in December?

Source: FRED

Leave A Comment