With US homebuilder stocks having their worst year since 2007, hope is high that September will show the long-awaited rebound in home sales (despite a soaring mortgage rate).

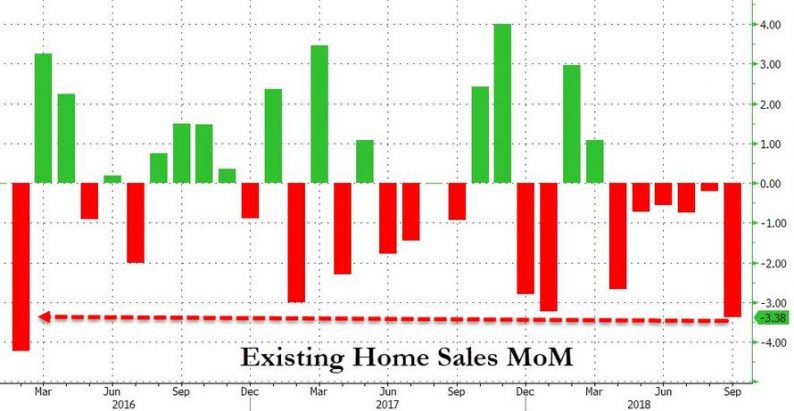

After ‘stabilizing’ unchanged in August, existing home sales were expected to drop 0.9% MoM in September, but instead, August’s data was revised notably lower and September plunged… down 3.4% MoM – the biggest drop since Feb 2016.

With SAAR at its lowest since Nov 2015…

This is the seventh month in a row of annual declines in existing home sales…

Sales fell across all price ranges (not just the low-end as we have seen recently).

Median home price rose 4.2% from last year to $258,100

And you can’t blame supply as it rose notably – 4.4 months supply in Sept. vs. 4.3 in Aug.

As NAR notes:

“This is the lowest existing home sales level since November 2015”, he said.

“A decade’s high mortgage rates are preventing consumers from making quick decisions on home purchases.All the while, affordable home listings remain low, continuing to spur underperforming sales activity across the country”.

“There is a clear shift in the market with another month of rising inventory on a year over year basis, though seasonal factors are leading to a third straight month of declining inventory”, said Yun.

“Homes will take a bit longer to sell compared to the super-heated fast pace seen earlier this year”.

Homebuilder stocks are collapsing…

This is the worst year for homebuilder stocks since 2007…

Probably nothing. Just keep hiking rates.

Leave A Comment