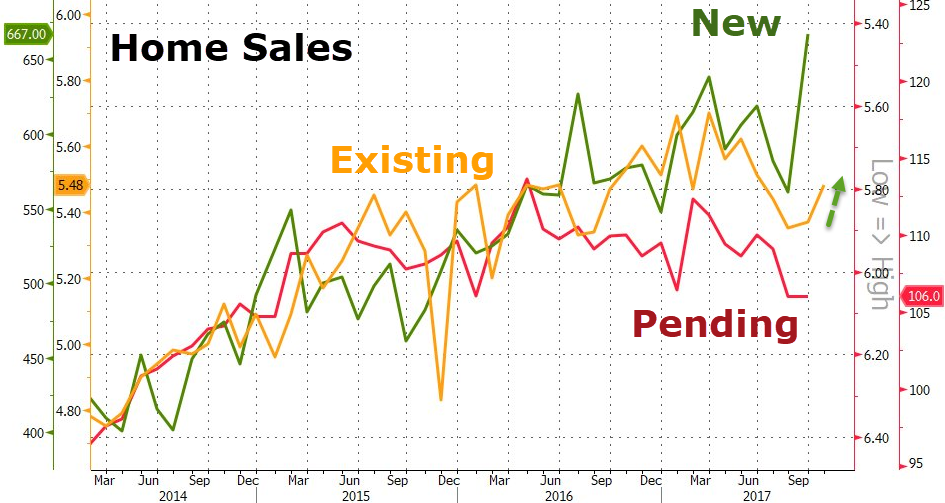

Following September’s positive housing data rebound, October data is starting well with existing home sales surging 2.0% MoM (better than expected 0.2%) to 5.48mm SAAR, as the US existing home sales inventory tumbled 10.4% YoY, to 1.8 months, the lowest since 1999.

Sales of previously owned U.S. homes rose to a four-month high, indicating demand was firming at the start of the quarter as the impact from hurricanes faded, according to a National Association of Realtors report released Tuesday.

However, this is the second straight YoY sales decline, first back-to-back months since 2014…

The median sales price increased 5.5% YoY to $247,000.

Bloomberg reports that Houston and several areas of Florida saw gains when compared with a year earlier, while Miami is still showing some softness, according to NAR.

As in the past, economic activity including in the housing industry typically bounces back after major storms as rebuilding and repair work gets underway.

Another possible headwind comes from tax legislation being advanced in Congress, which the Realtors association strenuously opposes.

The group said last week that the plans debated by lawmakers would “overwhelmingly remove the tax incentive to purchase and own a home in America,” and economists surveyed by Bloomberg said the House bill would reduce demand from homebuyers.

“The momentum appears to be good,” Lawrence Yun, NAR’s chief economist, said at a press briefing accompanying the report. The hurricane impact was “more modest” than anticipated in October and activity is “quickly bouncing back.”

The tax plan could be a “major wild-card disrupter to the housing recovery,” he said. Even so, he sees another “respectable year in 2018,” provided any tax changes don’t set back demand.

Leave A Comment