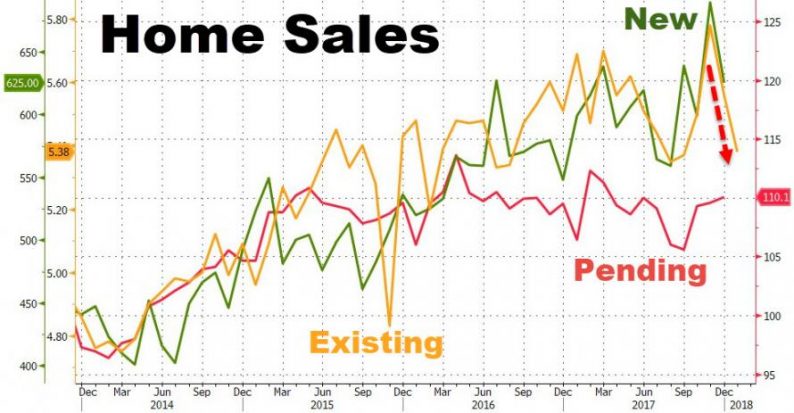

After new- and existing-home sales tumbled in December, expectations were for a modest 0.5% rebound in January (despite plunging mortgage applications and soaring rates). But that did not happen as existing home sales tumbled 3.2% MoM to its lowest level since Aug 2016.

Existing Home Sales are unchanged since June 2015…

(NOTE – this data is based on signed contracts from Nov/DEC, which means the recent spike in rates is not even hitting this yet)

Of course NAR is careful to blame inventories – and not soaring rates affecting affordability: Lawrence Yun, NAR chief economist, says January’s retreat in closings highlights the housing market’s glaring inventory shortage to start 2018.

“The utter lack of sufficient housing supply and its influence on higher home prices muted overall sales activity in much of the U.S. last month,” he said.

“While the good news is that Realtors® in most areas are saying buyer traffic is even stronger than the beginning of last year, sales failed to follow course and far lagged last January’s pace.

“It’s very clear that too many markets right now are becoming less affordable and desperately need more new listings to calm the speedy price growth.”

The median existing-home price in January was $240,500, up 5.8% from January 2017.

First-time buyers were 29 percent of sales in January, which is down from 32 percent in December 2017 and 33 percent a year ago.

“The gradual uptick in wages over the last few months is a promising development for the housing market, but there’s risk these income gains could be offset by the recent jump in mortgage rates,” said Yun.

“That is why the pace of added new and existing supply in the months ahead is worth monitoring. If inventory conditions can improve enough to cool the swift price growth in several markets, most prospective buyers should be able to absorb the higher borrowing costs.”

Leave A Comment