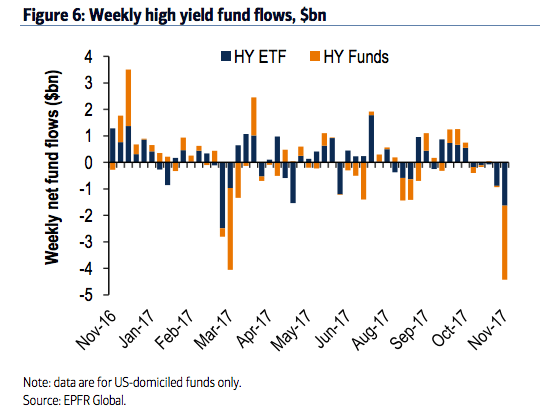

Just how nervous did folks get during the junk bond rout that finally took a breather when spreads tightened materially on Thursday? Well, pretty damn nervous, according to the flows data.

“Following the decline in high yield bond prices this month, high yield US funds and ETFs reported $4.43bn in outflows this past week,” BofAML writes on Friday, citing EPFR. That would be the third largest exodus on record and the largest since August 2014:

Is it time to buy the dip? In short: probably not. As Goldman writes in their weekly credit trader note, this really shouldn’t come as a surprise. For months, the bank has suggested that decompression is likely to remain the trend especially given HY’s exposure to idiosyncratic, sector-specific risk. With that in mind, they’re sticking with their long-held view:

In our view, the key risk going forward is that the numerous pockets of idiosyncratic risk in the HY market gradually morph into a directional driver of risk appetite as opposed to a driver of dispersion across issuers and sectors. With HY spreads still around their 25th historical percentile, despite the recent move wider, this risk warrants close attention. On a relative basis, we reiterate our IG/HY decompression view as well as “up in quality” view within HY, preferring BBs over Bs and CCCs.

That bolded bit is important. The words “numerous” and “idiosyncratic” do not work well together beyond a certain point. When the peculiar becomes the norm, dispersion becomes a directional driver of risk more generally.

Oh, and do note that limiting the deductibility of interest expenses could very well mute the ostensibly positive impact of tax reform on HY. Here’s Goldman again:

For the low end of the HY market where issuers typically have interest expenses in excess of the 30% EBITDA threshold, the consequences are negative, even after allowing for a lower marginal rate. This is illustrated in Exhibit 2 which shows the distribution of the effective tax rate for the universe of US-domiciled firms in the iBoxx HY index that have a net interest expense to EBITDA ratio above the 30% threshold (for context this universe represent 40% of the total index-eligible bonds outstanding issued by US-domiciled firms). The key takeaway from Exhibit 2 is that, even though the year-end 2016 data suggests a large portion of firms with a net interest expense to EBITDA ratio higher than 30% is non-profitable, a 5-year look-back window reveals that a higher portion happens to have a 5-year median effective tax rate that is lower than the proposed statutory rate of 20%. From a market standpoint, we think the upcoming tax legislation will likely drive more dispersion and decompression.

Leave A Comment