We all know that software is eating the world.

For better or worse, that statement applies to the financial world as well. It is said today that 75% of all financial market volume is automated, though there are lower and higher estimates out there depending on the report.

The bottom line is that algorithmic trading is the dominant market player – and this has benefits and drawbacks for average investors. On the upside, markets are less volatile and presumably more rational because they are driven by computers instead of fallible humans.

On the other hand? Sometimes algos just go rogue and do something unpredictable.

When the British pound flash crashed earlier this month, it was exactly this latter thing that happened.

EXPLAINING THE OCTOBER FLASH CRASH IN THE BRITISH POUND

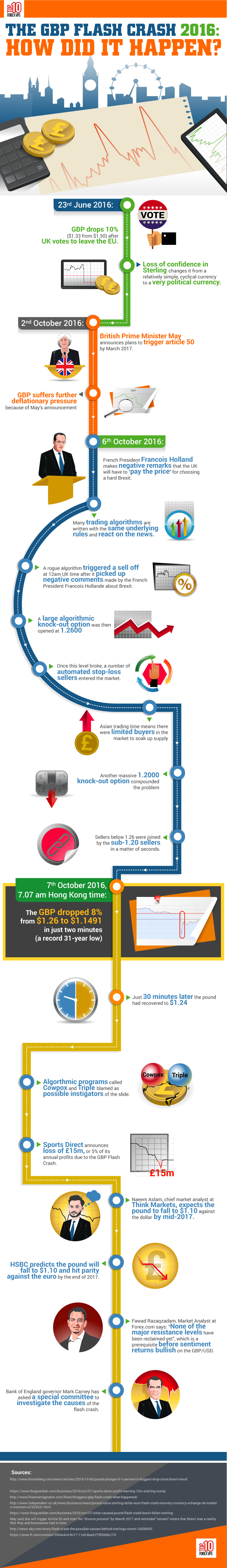

The following infographic from Top 10 Forex VPS shares a play-by-play breakdown of how the British pound crashed a whopping 8% in just two minutes.

It’s interesting because it helps give a sense of how the piping works behind these trading algorithms. It’s also a cautionary tale of algos gone wild, showing how market momentum can be swung in a particular direction even without your average market participants being involved.

In the aftermath of Brexit, the British pound has subsequently morphed into a “political” currency that seems to get most of its trading action based on commentary and speculation about the country’s eventual withdrawal from the EU.

On October 6, 2016, François Hollande said that the UK must “pay the price” for Brexit. Trading algorithms reacted to this news that they deemed to be negative, and it triggered a GBP selloff. Once a massive knock-out option was opened and a certain price broke, it triggered a number of automated stop-loss sellers.

After a few other algorithms kicked in, the British pound went from $1.26 to $1.1491 in a matter of just two minutes in USD terms. That’s a 8% slide in a globally significant currency.

Leave A Comment