Real Estate Investment Trusts, or REITs, are the best way for regular investors to gain exposure to high-quality real estate assets, including the fast growing storage space sector.

Extra Space Storage (EXR) is one of the best blue chip storage space REITs, with a great track record of growing investors’ income and wealth over the long term.

In fact, EXR’s stock has returned nearly 600% over the last decade, and the company’s dividend has increased by 680% during the previous five years.

However, while many value-focused dividend investors might worry that Extra Space Storage is now overvalued, this quality storage REIT still has plenty of growth potential ahead of it.

Let’s take a closer look at Extra Space Storage to see if this high-yield REIT could make sense for conservative retired investors living off dividends.

Business Description

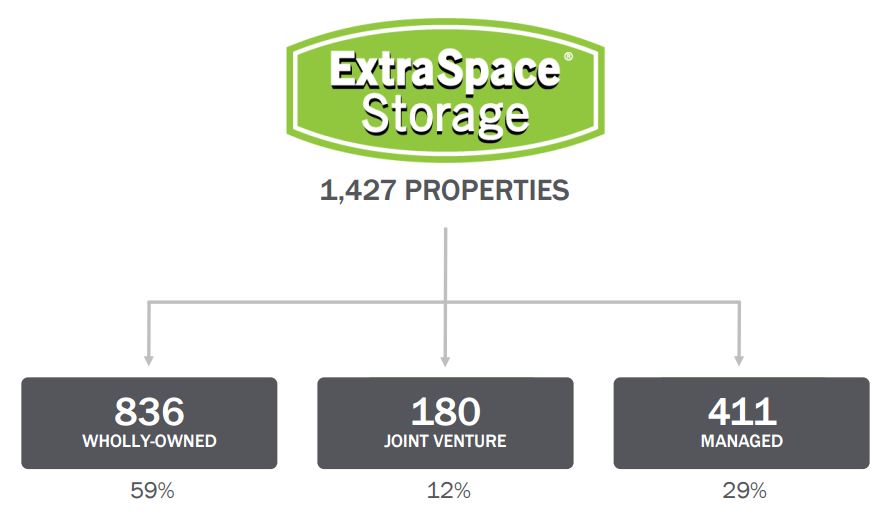

Extra Space Storage is America’s second largest public storage REIT, owning or operating over 1,400 properties in 38 states, Washington DC, and Puerto Rico.

The company’s properties total 910,000 storage units containing 103 million square feet of rentable space.

Source: Extra Space Storage Investor Presentation

The company is very well diversified geographically, helping to create a very consistent stream of cash flow from which to pay its fast growing and secure dividends.

California (19%), Texas (10%), and Florida (10%) are its biggest states. The Northeast (16%) is also meaningful, but no single region is large enough to bring the company down.

Business Analysis

Since inception in the early 1970’s, the storage industry has been the fastest growing segment of the commercial real estate industry, according to the Self-Storage Association.

According to the Self-Storage Almanac, in 2000 there were only 31,947 self-storage properties in the U.S. Today, there are more than 50,000 properties.

Increased population density and an aging population have helped drive the surge in storage properties, and Extra Space Storage has certainly benefited from these trends since its founding in 1977.

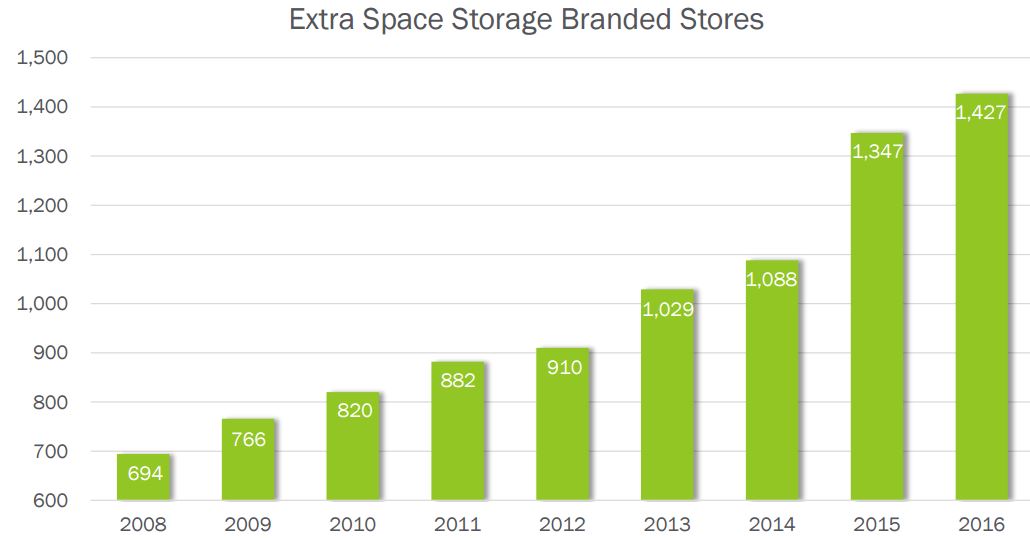

Extra Space Storage has been growing like a weed, with a blistering pace of revenue and earnings growth over time. In fact, the company’s revenue has nearly tripled over the last five years. This is due to two main factors.

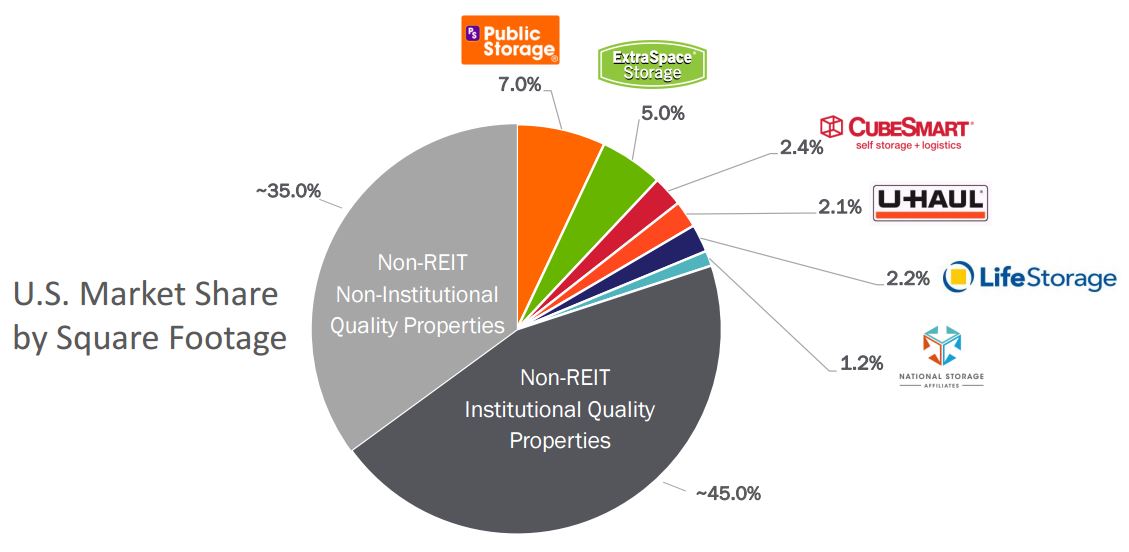

First, management has been very aggressive in consolidating the highly fragmented public storage industry, of which Extra Space Storage, despite being the second largest player, holds only a 5% market share.

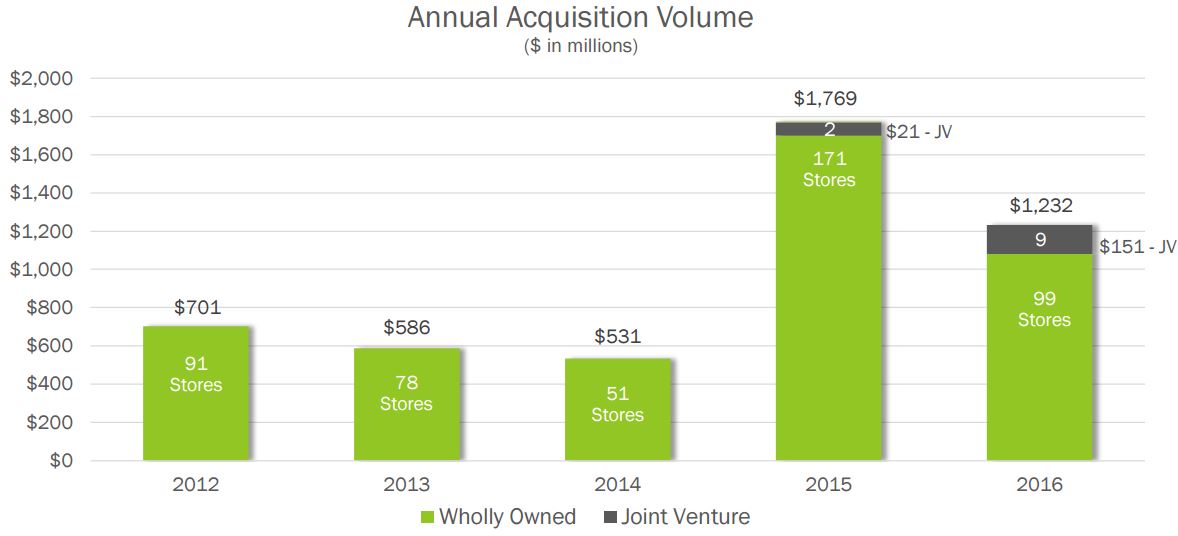

As seen below, Extra Space Storage spent more than $1 billion on acquisitions in each of the last two years.

Source: Extra Space Storage Earnings Supplement Presentation

This aggressive acquisition spree has led to some very impressive growth in the REIT’s store count, which has more than doubled since 2008.

According to the Self-Storage Almanac, the top 50 self-storage companies owned approximately 21.9% of the total U.S. stores in 2015, providing many opportunities for further acquisitive growth.

While some industries consolidate because their best growth days are behind them, the public storage industry is expected to continue growing over the long term, thanks to America’s aging demographics.

Between 2012 and 2060, America’s population of those over age 65 is expected to grow by nearly 50 million.

Many older Americans are expected to downsize out of large homes to much smaller homes and apartments, especially to help with retirement funding, which creates a secular growth catalyst for public storage facilities.

Another key aspect to Extra Space Storage’s business model is its third party management segment (the largest in the U.S. with a market share of 6%), in which the company runs storage properties it doesn’t own on behalf of the property owner.

This allows the REIT to leverage its expertise into a low cost, high-margin cash flow stream.

Better yet, thanks to this fast growing business, Extra Space Storage also grows its potential future property acquisition pipeline, ensuring strong growth into the future.

Leave A Comment