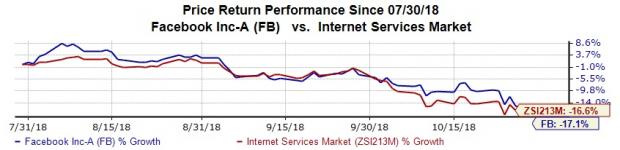

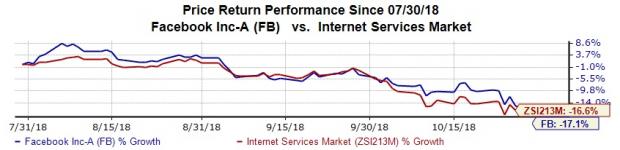

Social media giant Facebook (FB – Free Report) is set to release third-quarter fiscal 2018 results on Oct 30 after market close. The company witnessed a tumultuous ride in the recent months in the wake of the broad tech sector turmoil, losing 17.1% over the past three months. This compared unfavorably with the industry decline of 16.6%.

The underperformance might continue given the negative earnings revision trend.

Earnings Whispers

Facebook has a Zacks Rank #3 (Hold) and an Earnings ESP of -2.89%. According to our surprise prediction methodology, the combination of a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 when combined with a positive Earnings ESP increases the odds of an earnings beat. A Zacks Rank #4 or 5 (Sell rated) is best avoided going into the earnings announcement, especially when the company is seeing negative estimate revisions. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Facebook has seen negative earnings estimate revision of a penny over the past seven days for the third quarter. Analysts decreasing estimates right before earnings — with the most up-to-date information possible — is a pretty bad indicator for the stock. Additionally, Facebook is expected to record earnings decline of 8.2% in the soon-to-be-reported quarter. However, Facebook’s earnings surprise history is robust with the company delivering a positive earnings surprise of 14.80% on average over the past four quarters. Revenues are expected to grow by 33.7%.

Further, the stock belongs to a top-ranked Zacks Industry (top 43%) and has a solid Growth Score of B. According to the analysts polled by Zacks, Facebook has an average target price of $204.97, with nearly 85% of the analysts giving a Strong Buy or a Buy rating ahead of the company’s earnings. This represents 44.2% upside from the current price.

What to Watch?

The social media giant had warned of continued deceleration in revenues in the second half of the year. The company expects revenue growth rates to decline in high single-digit percentages sequentially in both the third and fourth quarters. Further, Facebook said its operating margin is expected to fall to the “mid-30s on a percentage basis” over a more than two-year period.

Leave A Comment