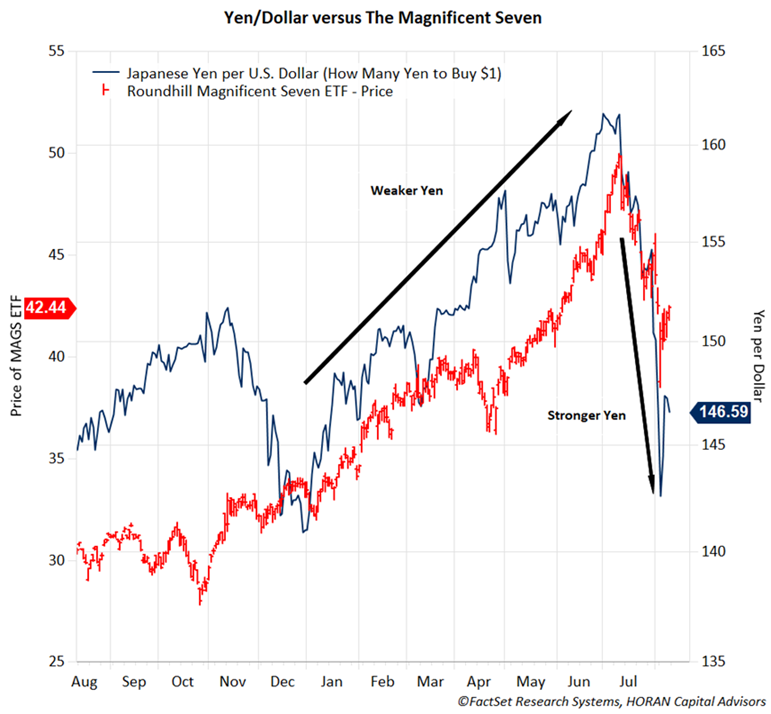

Over the course of a little more than three weeks the S&P 500 Index fell -8.48% from its high on July 16 to a recent low on August 5. Since last Monday’s low the S&P 500 Index has recovered about 3% of its decline. According to BofA Global Research, -5%+ corrections have occurred on average three times per year since 1930 and 10% corrections about once per year. Strategists have attempted to assign various reasons for the recent decline with some reasons more plausible than others. What is clear though is the S&P 500 index has had a stellar first half to 2024, providing investors with a near 20% gain in the first seven months of the year as seen in the below chart. Perhaps investors were looking for a reason to trim some equity in their portfolio. For most of this year the so-called Magnificent Seven stocks, the mega cap stocks with a heightened focus on artificial intelligence (AI), have contributed an outsize amount to the market’s return. What seems to be evident is some hedge funds and institutional investors have used leverage to invest in the Magnificent Seven group of stocks. One strategy utilized is known as the yen carry trade. This strategy is one where investors borrow funds in Yen as interest rates in Japan have remained near zero percent for years. The borrowings in Yen are then converted to currencies in other markets, for example, the US Dollar, and reinvested in those markets and in areas like the Magnificent Seven stocks.On July 31 the Bank of Japan increased interest rates by .25% or 25 basis points, the first increase since 2007. On the following Monday Japanese stocks as measured by the Nikkei 225 Index declined a significant -12%. For those investors involved in the Yen carry trade, higher rates in Japan served as a tailwind for the Yen to strengthen; thus, making it more expensive for investors to convert the non-Yen currencies back into the Yen. Also, the increased interest rate made the Yen borrowings more expensive as well. Investors utilizing the Yen carry trade had to sell investments that were purchased with Yen borrowings and some of those investments appear to be in the Magnificent Seven stocks. The end result was the Magnificent Seven stocks declined as the Yen strengthened as seen in the below chart.

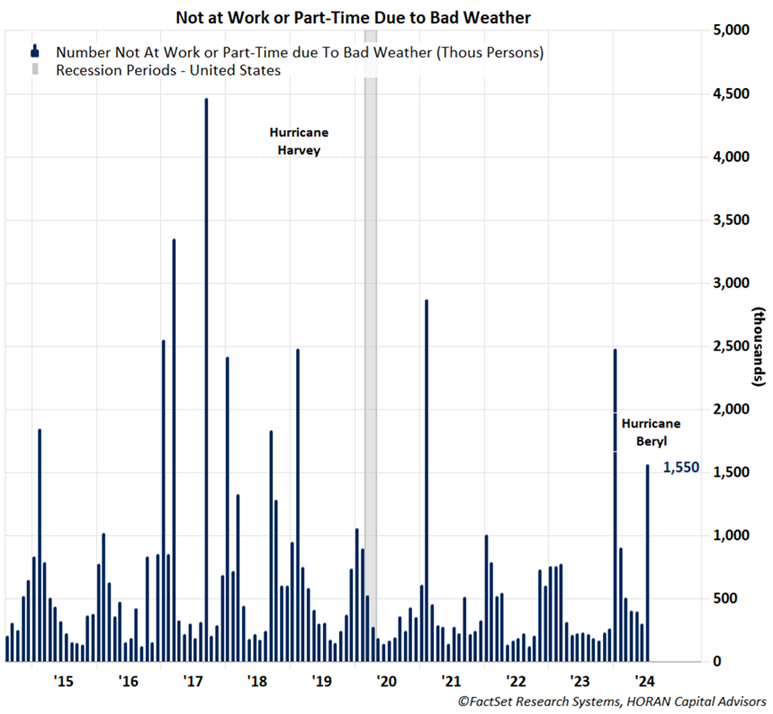

For most of this year the so-called Magnificent Seven stocks, the mega cap stocks with a heightened focus on artificial intelligence (AI), have contributed an outsize amount to the market’s return. What seems to be evident is some hedge funds and institutional investors have used leverage to invest in the Magnificent Seven group of stocks. One strategy utilized is known as the yen carry trade. This strategy is one where investors borrow funds in Yen as interest rates in Japan have remained near zero percent for years. The borrowings in Yen are then converted to currencies in other markets, for example, the US Dollar, and reinvested in those markets and in areas like the Magnificent Seven stocks.On July 31 the Bank of Japan increased interest rates by .25% or 25 basis points, the first increase since 2007. On the following Monday Japanese stocks as measured by the Nikkei 225 Index declined a significant -12%. For those investors involved in the Yen carry trade, higher rates in Japan served as a tailwind for the Yen to strengthen; thus, making it more expensive for investors to convert the non-Yen currencies back into the Yen. Also, the increased interest rate made the Yen borrowings more expensive as well. Investors utilizing the Yen carry trade had to sell investments that were purchased with Yen borrowings and some of those investments appear to be in the Magnificent Seven stocks. The end result was the Magnificent Seven stocks declined as the Yen strengthened as seen in the below chart. Also getting into the data mix was the Federal Reserve. The FOMC meeting ended on July 31 and the committee’s stance on interest rates left rates unchanged with a rate hike “on the table” at the next FOMC meeting in mid-September. Then, two days later, i.e., Friday August 2, and the Fed most likely had this information at hand a few days earlier, the July nonfarm payrolls number was reported at 114,000, lower than the expected 175,000. These numbers often get revised in subsequent monthly reports but nonetheless, the market viewed the weaker payrolls figure as a weakening employment environment. One interesting data point in the July nonfarm payroll report was the increase in the number of individuals that stated they were not at work or were working part-time due to bad weather. This figure was reported at 1,550,000, up from 289,000 in June. What is known is Hurricane Beryl impacted the south, specifically Texas. In September 2017 a similar but much larger spike in this category was reported following Hurricane Harvey. As the months move forward, one would expect this variable to decline.

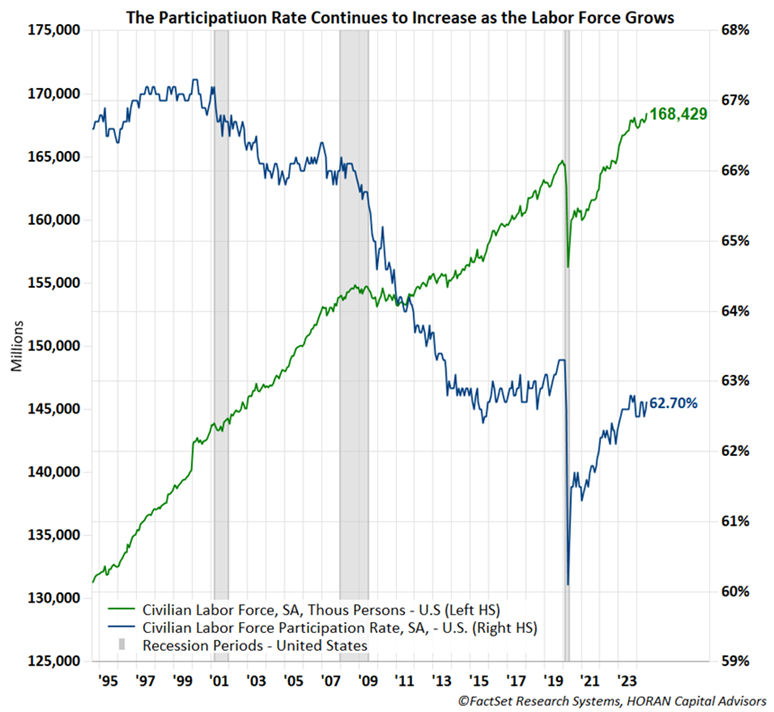

Also getting into the data mix was the Federal Reserve. The FOMC meeting ended on July 31 and the committee’s stance on interest rates left rates unchanged with a rate hike “on the table” at the next FOMC meeting in mid-September. Then, two days later, i.e., Friday August 2, and the Fed most likely had this information at hand a few days earlier, the July nonfarm payrolls number was reported at 114,000, lower than the expected 175,000. These numbers often get revised in subsequent monthly reports but nonetheless, the market viewed the weaker payrolls figure as a weakening employment environment. One interesting data point in the July nonfarm payroll report was the increase in the number of individuals that stated they were not at work or were working part-time due to bad weather. This figure was reported at 1,550,000, up from 289,000 in June. What is known is Hurricane Beryl impacted the south, specifically Texas. In September 2017 a similar but much larger spike in this category was reported following Hurricane Harvey. As the months move forward, one would expect this variable to decline. A positive is the fact the civilian labor force continues to experience growth. This tends to occur as individuals on the sidelines move back into the labor pool looking for employment as they see job opportunities are available. This generally occurs when the economy is expanding and the first reading on GDP in July showed the U.S. economy grew at a 2.8% annualized rate in the second quarter up from 1.4% in the first quarter.

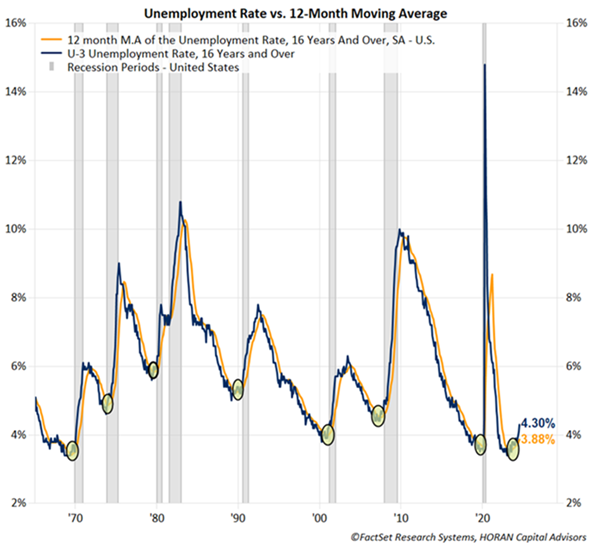

A positive is the fact the civilian labor force continues to experience growth. This tends to occur as individuals on the sidelines move back into the labor pool looking for employment as they see job opportunities are available. This generally occurs when the economy is expanding and the first reading on GDP in July showed the U.S. economy grew at a 2.8% annualized rate in the second quarter up from 1.4% in the first quarter. Lastly on employment, a variable worth tracking is the monthly unemployment rate. As the below chart shows the monthly rate recently crossed above the 12-month moving average of the monthly rate. Historically this has occurred near recessions and is similar to the recently cited Sahm Rule.

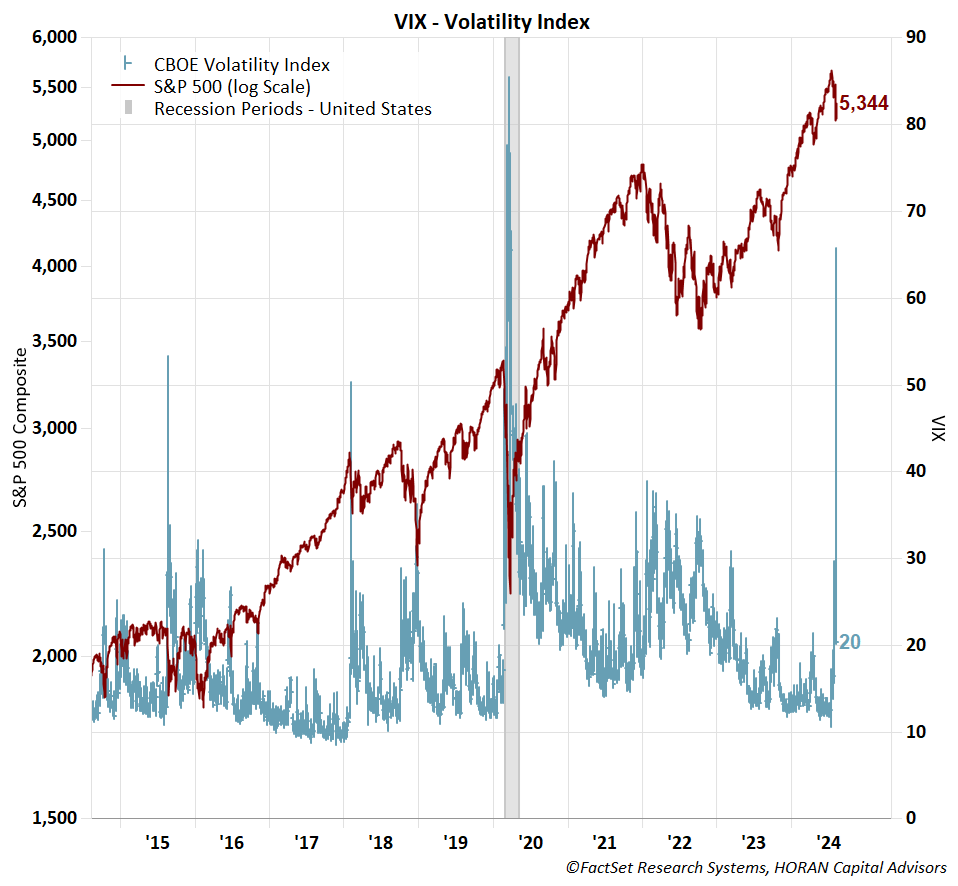

Lastly on employment, a variable worth tracking is the monthly unemployment rate. As the below chart shows the monthly rate recently crossed above the 12-month moving average of the monthly rate. Historically this has occurred near recessions and is similar to the recently cited Sahm Rule. In conclusion, what has been abnormal about the equity market this year has been the nearly uninterrupted move higher until this past month. When the CBOE Volatility Index (VIX) spikes it is a sign of potentially higher equity market volatility in the subsequent 30-day period. On Monday last week, the VIX Index reached 66 on an intraday basis and likely signals at least a market bottom occurring sometime in the near term. The market will not move higher in a straight line so investors should expect more volatility, especially as the presidential election nears.

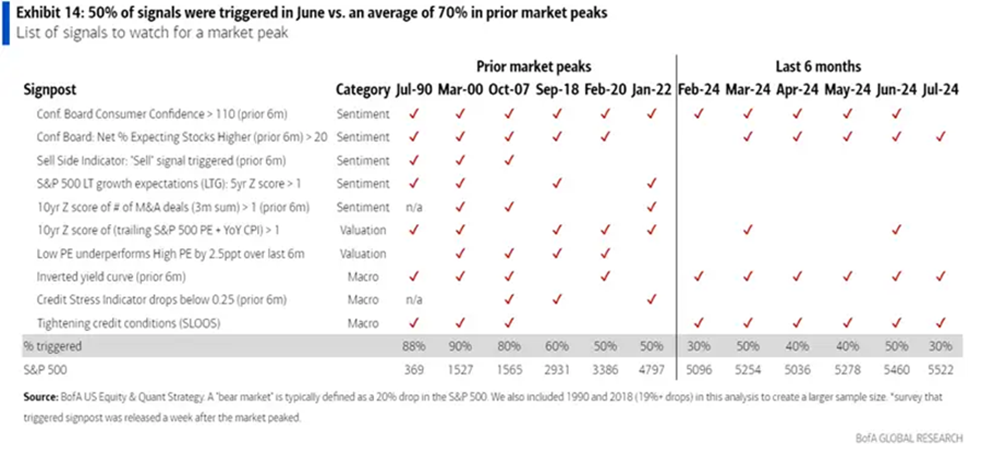

In conclusion, what has been abnormal about the equity market this year has been the nearly uninterrupted move higher until this past month. When the CBOE Volatility Index (VIX) spikes it is a sign of potentially higher equity market volatility in the subsequent 30-day period. On Monday last week, the VIX Index reached 66 on an intraday basis and likely signals at least a market bottom occurring sometime in the near term. The market will not move higher in a straight line so investors should expect more volatility, especially as the presidential election nears. Not that the economy and the market are one and the same, but a growing economy is certainly positive for companies and hence stocks. A recent table from BofA Global Research shows ten variables the firm tracks to determine the likelihood of a recession. As seen below only 3 of the 10 variables are signaling a market peak and prior market peaks have occurred when 70% of the variables are triggered. Certainly, there are concerns with the economy worth tracking, but at the moment more of the data seems to be falling on the positive side of the ledger versus the negative side.

Not that the economy and the market are one and the same, but a growing economy is certainly positive for companies and hence stocks. A recent table from BofA Global Research shows ten variables the firm tracks to determine the likelihood of a recession. As seen below only 3 of the 10 variables are signaling a market peak and prior market peaks have occurred when 70% of the variables are triggered. Certainly, there are concerns with the economy worth tracking, but at the moment more of the data seems to be falling on the positive side of the ledger versus the negative side.  More By This Author:Broader Market Participation ContinuesRotation Into Small Cap Stocks The Magnitude Of The Difference In Return A Greater Issue Than A Narrow Market

More By This Author:Broader Market Participation ContinuesRotation Into Small Cap Stocks The Magnitude Of The Difference In Return A Greater Issue Than A Narrow Market

Leave A Comment