Economists continue to claim that manufacturing just doesn’t matter and that the service economy is more than fine. Setting aside the obvious link between services and goods to begin with (since so many services are dedicated to managing, moving and especially selling goods), it just doesn’t add up; if consumers are freely spending on services then why would they so eschew goods? If it were just a minor slowing in manufacturing (which has spread to our trade partners, no less) it would be far more plausible in that manner, but the global goods economy, which remains the bedrock core association, is already showing up in recession form. Just in America, manufacturing hasn’t hit a speedbump but rather a conspicuous wall.

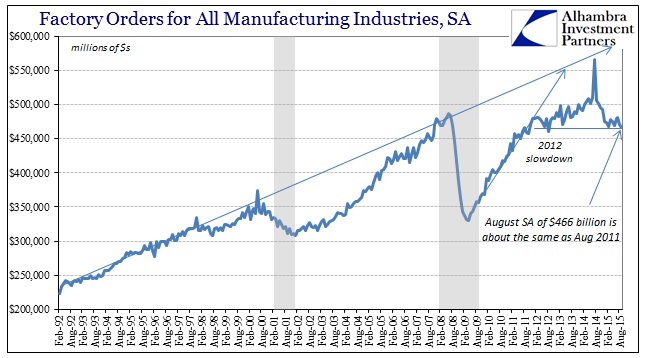

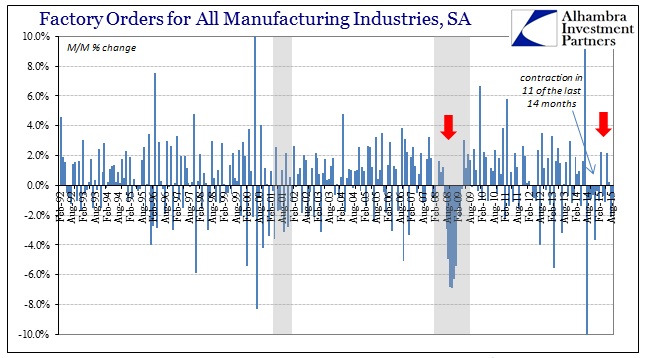

The latest figures to demonstrate that are factory orders. No matter the version, seasonally adjusted or not, they are recessionary – and have been for more than 6 months now. Not counting the base effects from July 2014 (which produced a -15% Y/Y contraction for July 2015), the other five months of the past six have been, in order, -6.5%, -8.3%, -4.2%, -7.0%, and -7.1% for September. Seasonally-adjusted, factory orders have declined month-over-month by more than 1.1% in each of the past two. That has the monthly level for orders, a forward-looking economic indication, at the lowest level since the middle of the 2012 slowdown. It took the crash to November 2008 and the bottom of dot-com recession in early 2002 to accomplish that feat, erasing three yearsof factory gains.

The seasonally-adjusted series has now contracted in 11 out of the past 14 months, leaving the manufacturing economy far behind its needed trend with no end in sight. Recessions are not just contractions but rather accumulations of contractions that persist until the general business environment, that by its nature holds to optimism even without any QE-insanity, is forced to relent in full. What these figures show is that manufacturing has already been captured by just such a serious contraction and one that has accosted already more than a year (since the prior slowdown trend was broken). With inventory still accumulating but only at a slightly slower pace (which is what “hit” Q3 GDP; inventory is still gaining but now at just near a record pace) the only options left are a sudden and biblical surge in consumerism or where business gives up and shifts to cuts (in production, material and especially labor utilization).

Leave A Comment