Guest post by New Deal democrat (from Bonddad blog)

Failure to deflate: flat consumer prices only slightly help real wages, sales

Usually changes in the inflation rate are all about the price of gasoline. Not in October. Although gas prices fell -6.4% (compared with a decline of -5.0% a year ago), unlike one year ago net consumer price failed to decline, instead remaining flat.

Over a two month period, a -8.6% decline in gas (vs. -6.1% in 2013) coincident with a 0.1% increase in prices, vs. a gain of +0.2% in 2013. There seems to have been no single culrpit. A wide variety of other prices slightly more than expected.

As a result, while measures of real sales and real wages did increase, they did not do so as much as expected.

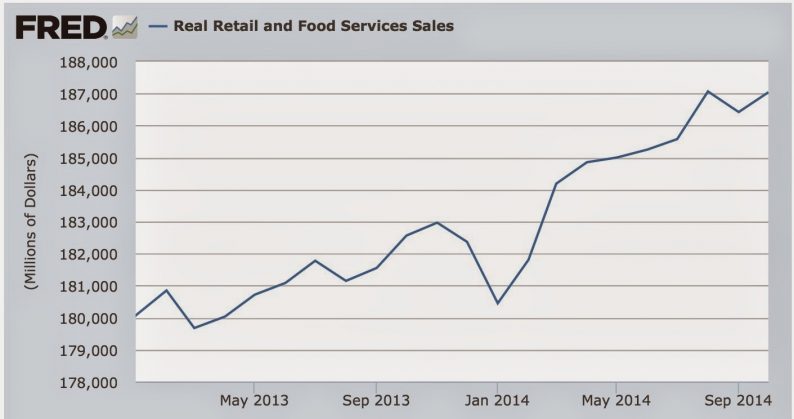

First of all, here are real retail sales:

These returned to August levels.

Real retail sales per capita are a long leading indicator, typically turning one year or more before the economy as a whole. October’s increase still leaves these below August’s level:

Real wages also increased, but are still below February’s level, and are still about 0.7% below their 2010 post-recession peak:

Of course, even that level was below virtually the entire 1970s peak for real wages:

Leave A Comment