Fair Isaac Corporation (FICO) makes decisions smarter. The company’s solutions and technologies for Enterprise Decision Management give businesses the power to automate more processes, and apply more intelligence to every customer interaction. Through increasing the precision, consistency and agility of their decisions, Fair Isaac clients worldwide increase sales, build customer value, cut fraud losses, manage credit risk, reduce operational costs, meet changing compliance demands and enter new markets more profitably. Fair Isaac powers hundreds of billions of decisions each year in financial services, insurance, telecommunications, retail, consumer branded goods, healthcare and the public sector.

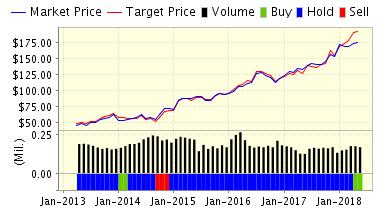

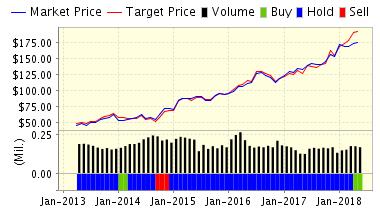

We updated its recommendation from BUY to STRONG BUY for FAIR ISAAC INC on 2016-05-09. Based on the information we have gathered and our resulting research, we feel that FAIR ISAAC INC has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Sharpe Ratio and P/E Ratio.

ValuEngine Forecast

Target

Price*

Expected

Return

1-Month

3-Month

6-Month

1-Year

2-Year

3-Year

Valuation & Rankings

Valuation

75.00% undervalued

Valuation Rank

100

1001-M Forecast Return

1.58%

1-M Forecast Return Rank

100

10012-M Return

23.36%

Momentum Rank

89

89Sharpe Ratio

0.94

Sharpe Ratio Rank

97

975-Y Avg Annual Return

25.46%

5-Y Avg Annual Rtn Rank

96

96Volatility

27.12%

Volatility Rank

63

63Expected EPS Growth

74.75%

EPS Growth Rank

83

83Market Cap (billions)

3.42

Size Rank

81

81Trailing P/E Ratio

7.28

Trailing P/E Rank

95

95Forward P/E Ratio

4.17

Forward P/E Ratio Rank

98

98PEG Ratio

0.10

PEG Ratio Rank

84

84Price/Sales

4.02

Price/Sales Rank

22

22Market/Book

8.03

Market/Book Rank

14

14Beta

1.42

Beta Rank

25

25Alpha

0.20

Alpha Rank

87

87

Leave A Comment