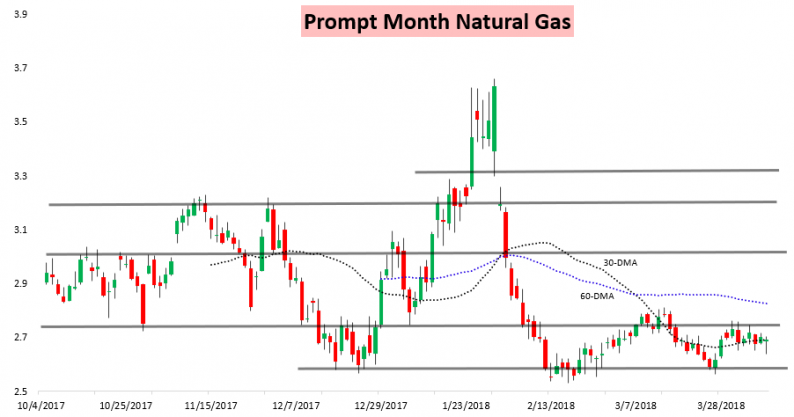

May natural gas prices settled down just a few ticks on the day as heavy selling early was met with buying off the $2.65 support level.

Prices recovered the most at the front of the strip, with later contracts generally lagging.

The result was a rather significant move upwards in K/M today, indicative of the role of significant heating demand expectations through April in driving some of the day’s price action.

Over the weekend we saw even further GWDD additions to our 15-day forecast, which seemed to help firm up support. Our Morning Update showed this with GWDDs significantly above average expected on aggregate.

The afternoon Climate Prediction Center 6-10 Day forecast showed some of these colder trends too.

Yet in our Morning Update we saw enough other bearish signs that we alerted our clients we had a slightly bearish sentiment even with these weather forecasts, calling for a test of $2.65.

Cold looks like it could linger through the balance of April as well, with yesterday’s runs of the CFSv2 weather model still showing a colder bias through Week 3 (though the weekly model is notoriously volatile).

Thus though it may be April, we continue to see weather mattering, and it remains one of the many catalysts that we track constantly for subscribers.

Leave A Comment