Remember that piece of sh*t Steinhoff position the ECB had on its books thanks to CSPP? That would be the one we wrote about last month in “Fallen Angels And Draghi’s Steinhoff Demons.”

Amid questions about whether Steinhoff’s trials and tribulations underscore the inherent danger in the central bank’s corporate bond buying program, Draghi defended CSPP has follows at the December post-meeting presser:

It is not unusual that losses may be happening. All other central banks that ran similar programmes – do we know whether they had losses? No, because they are not disclosing the issuers, the holdings… We are much, much more transparent. We have a risk framework which has served very very well since beginning of the existence of the ECB, and if we need to draw lessons, we will certainly draw lessons.

To be sure, these concerns are hardly confined to CSPP. If we learned anything from the eurozone debt crisis it’s that sovereign debt isn’t “risk free” either, but it would be obtuse to suggest that imperiled corporate debt doesn’t add a new dimension to the equation.

Here’s what BofAML had to say a few weeks ago about the ECB’s “fallen angel” risk:

Moreover, it looks like the ECB’s language towards owning Fallen Angels has become more tentative of late. If true, we think that this has the potential to make the spreads of Fallen Angels behave more like Falling Knives.

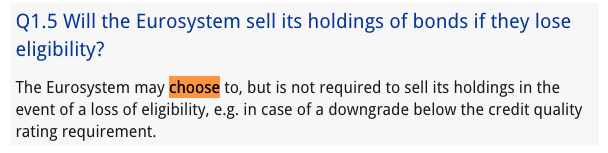

In other words, far from being able to depend on CSPP to tamp down idiosyncratic risk or at least contain the pain, the ECB may end up choosing to sell on a downgrade. Note the following screengrab from the central bank’s CSPP guidelines webpage:

Guess what? That didn’t use to say that. It used to say only this:

The Eurosystem is not required to sell its holdings in the event of a downgrade below the credit quality rating requirement for eligibility.

Leave A Comment