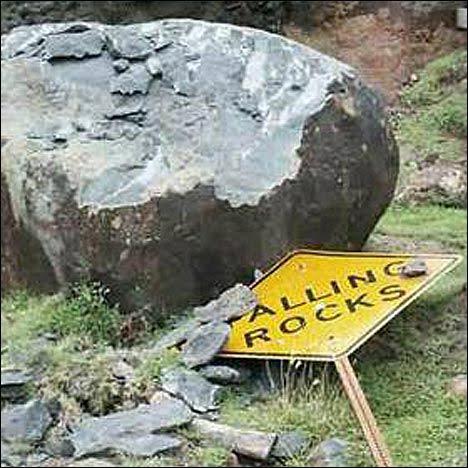

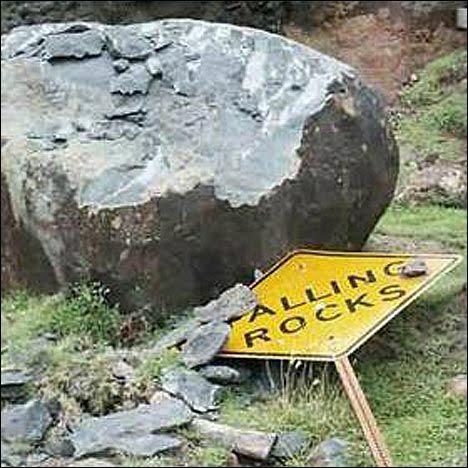

Yes, traumatic market events (falling rocks) occur, even though markets are “managed,” statistics are manipulated, and politicians pretend to care about something besides their next election.

From John P. Hussman, Ph.D. Fair Value and Bubbles: 2017 Edition

“Unfortunately, investors seem to have concluded that central bank easing is omnipotent, despite the fact that the Fed eased persistently and aggressively, to no effect, through the entire course of 2000-2002 and 2007-2009 market collapses.”

From Bill Gross: Bill Gross Says Market Risk is Highest Since Pre-2008 Crisis

“Central bank policies for low-and-negative-interest rates are artificially driving up asset prices while creating little growth in the real economy and punishing individual savers, banks, and insurance companies, according to Gross.”

From Billionaire Paul Singer:

“I’m very concerned about where we are in terms of the financial system, the economy, the American economy, the Global economy… After nine years of this artificial levitation on the part of financial assets – high-end real estate, art, the things that rich people buy – I think what we have today is a global financial system that’s just about as leveraged, and in many case more leveraged than before 2008.”

“Madoff Whistleblower Harry Markopolos Has Uncovered a New Fraud”

“Markopolos called what is left of the MBTA’s pension (Boston Transit Authority) a ‘Tender Vittles retirement plan’ meaning (sarcastically) that its participants would be eating cat food.” Is this different, except in degree, from Illinois, Chicago, New Jersey, CalPers (California) and many other pension plans?

“No good outcomes result when you mix politics and money,” Markopolos said.

From Karl Denninger: Illinois is Collapsing: It’s Coming Everywhere

Leave A Comment