The Fed’s Beige Book, a summary of economic activity in 12 Fed regions, claims modest wage increases broadened, manufacturing expanded, and light vehicle sales strengthened.

Let’s investigate those claims in detail, emphasis mine, then do a reality check on those ideas.

Overall Economic Activity

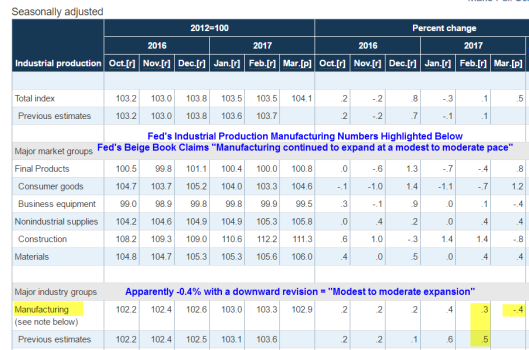

Economic activity increased in each of the twelve Federal Reserve Districts between mid-February and the end of March, with the pace of expansion equally split between modest and moderate. In addition, the pickup was evident to varying degrees across economic sectors. Manufacturing continued to expand at a modest to moderate pace, although growth in freight shipments slowed slightly. Consumer spending varied as reports of stronger light vehicle sales were accompanied by somewhat softer readings in non-auto retail spending.

Employment and Wages

Employment expanded across the nation and increases ranged from modest to moderate during this period. Labor markets remained tight, and employers in most Districts had more difficulty filling low-skilled positions, although labor demand was stronger for higher skilled workers. Modest wage increases broadened, and reports noted bigger increases for workers with skills that are in short supply.

Prices

On balance, prices rose modestly since the previous report. Input prices generally increased at a modest rate and outpaced gains in selling prices, which rose only slightly.

Manufacturing Expansion?

The curious thing about these numbers is the Beige Book and Industrial Production reports both come from the Fed!

Stregthening Light Vehicle Sales?

On April 3, I reported March Auto Sales Final Numbers: Down 5.7%, Two-Year Low; Don’t Worry, It’s Just a Plateau!

Also on April 3, I reported Auto Inventories Highest Since July 2009: Concerns Mount, Ford Vehicle Sales Decline 7.2%, GM Up 1.6%

Somewhat Softer Readings in Non-Auto Retail Spending?

Leave A Comment