I’m quite tortured about what to do this week, particularly on Thursday before Janet Yellen comes out spitting blood and declaring the need for Yet More Data in order to lift interest rates.

Anyway. Charts.

Some folks have been stacking stuff to SocialTrade indicating that an explosive move higher is imminent. It’s irrational, but I deeply resent those posts. I am the living god of confirmation bias, I realize, but posts like that just prod at my worst fears.

The thing I’ve realized for this entire year, though, is that the one regret that keeps coming up again and again and again is that I didn’t hold on long enough. I wimp out too early. I see the charts; I interpret the charts; I’m right about the charts; but fear causes me to take cover.

Here, let me cite one small example: the symbol TAXI. I wrote about this company many times (such as here, in July of 2014), and I quite rightly pointed out that Uber was going to ruin the taxi industry, and that TAXI should be shorted. Well, it’s lost about 33% of its value since then (and even when I did the post, it had already been trashed), but did I hang on? Absolutely not! (And I suspect it’ll just keep working its way toward $0).

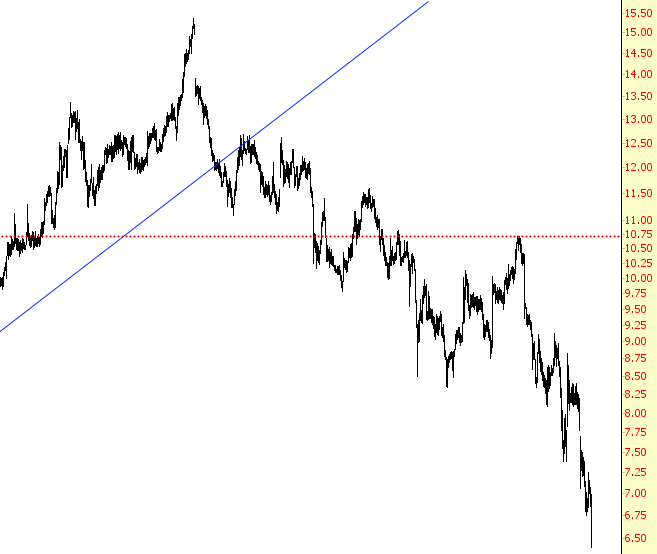

And don’t even get me started on energy producers. My Shifting Sands post from ten months ago boldly declared that “oil producers are the new gold miners” (in other words, headed for collapse). Let’s take a peek at the last ten months of the XOP in a percentage chart, shall we?

So, again, spot-on – dead spot on – but I only captured a portion of the move.

And so my “regret” over the past year has far more to do with premature closings than initial openings, so my temptation to cover all my positions and cower under a blanket while Yellen does her thing on Thursday is probably, shall we say, ill-advised. Again, I’ve laid out for Slope Plus folks what my strategic plan is, but that doesn’t mean I’m not still tied up in emotional knots about it.

Leave A Comment