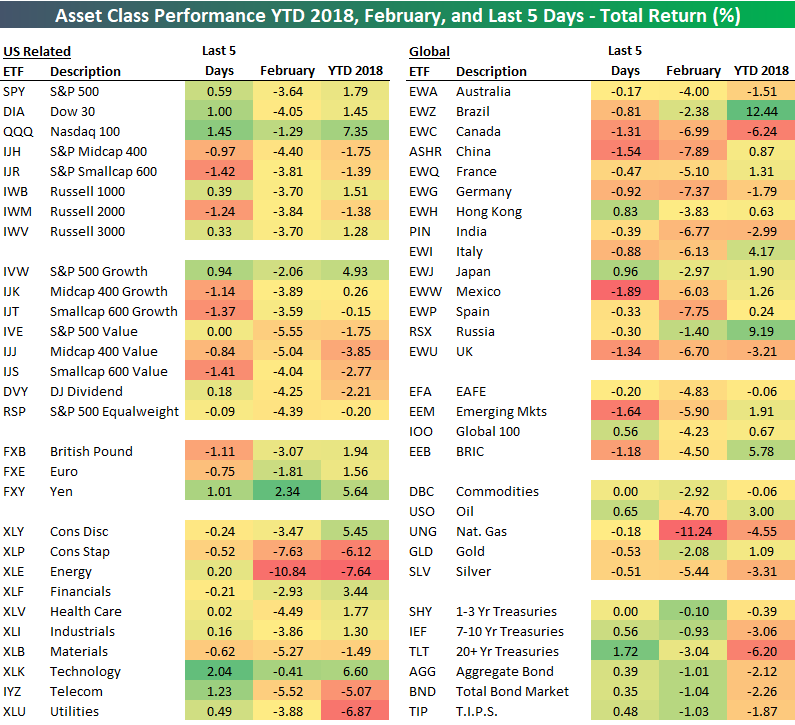

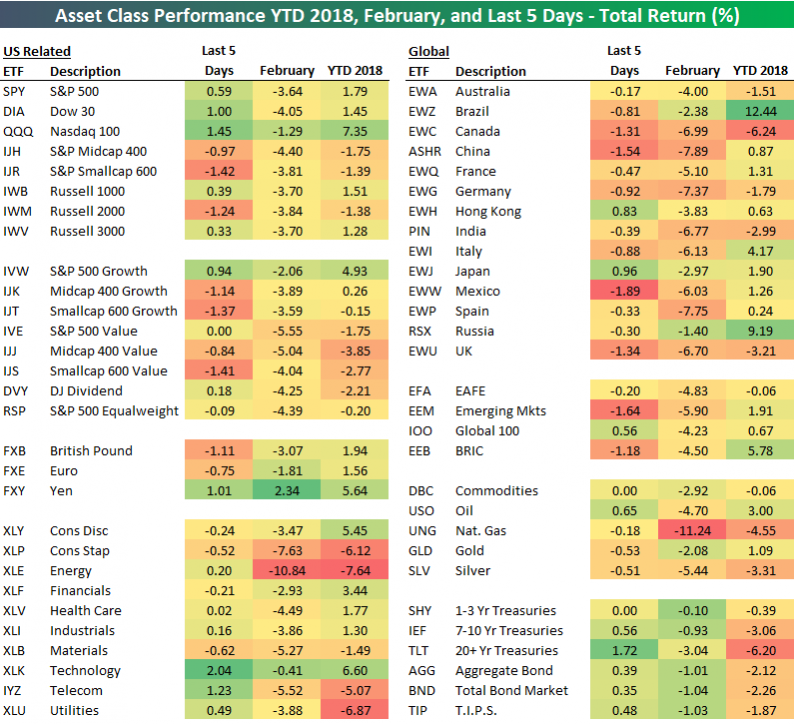

Below is a look at our asset class performance matrix showing the total return of a number of key ETFs across equities, fixed income, commodities, and currencies. For each ETF, we show its total return over the last week, in February, and year-to-date.

Major US index ETFs all fell in February, with the Dow (DIA) falling the most (-4.05%) and the Nasdaq 100 (QQQ) falling the least (-1.29%).Growth outperformed value by a wide margin. In fact, with a drop of 5.55%, the S&P 500 Value ETF (IVE) fell the most in February out of all the US index ETFs in our matrix.

Looking at the major S&P 500 sectors, Energy (XLE) got whacked by more than 10% in February, while Consumer Staples (XLP) fell 7.63%. Technology was the best performing sector on a relative basis with a drop of just 0.41% in February.

Outside of the US, every country ETF fell more than 1% in February.China (ASHR), Germany (EWG), and Spain (EWP) fell the most with drops of more than 7%, while Russia (RSX) and Brazil (EWZ) were down the least.Year-to-date, Brazil (EWZ) is the best performing ETF in the entire matrix with a gain of 12.44%.

Commodity ETFs in our matrix all fell in February too, with natural gas (UNG) down the most at -11.24%. And even though the drop in Treasuries (rise in interest rates) dominated the headlines during the month, Treasury ETFs were still some of the best performers compared to other asset classes.

Leave A Comment