The Bank of England’s (BoE) monetary policy meeting held on Thursday was the first this year. As widely expected the central bank held back from making changes to interest rates or to the bank’s asset purchases.

The central bank also released its quarterly inflation report.

Mark Carney, BOE governor. Image via Bank of England

Here are five key takeaways from the Bank of England’s meeting yesterday.

1. BoE leaves monetary policy unchanged

The Bank of England monetary policy committee (MPC) voted at its meeting on Thursday to leave interest rates unchanged at 0.25%, while keeping the asset purchase program steady at GBP435 billion. This was widely expected by economists. The BoE’s monetary policy statement continued to reflect the central bank’s neutral stance on interest rates, despite evidence of an uptick in inflation over the past few months.

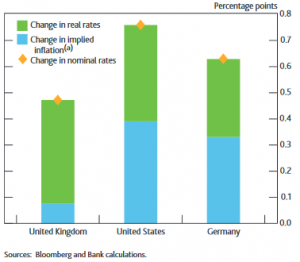

Implied Future Inflation Rates (Source: BoE)

The central bank has also communicated its tolerance to inflation overshooting the 2% target rate, although some MPC members said that they will tolerate only a “little room” for inflation to overshoot its limits. This could possibly mean that if inflation continues to rise above 2% there will be some dissenters along the way who are likely to vote in favor of a rate hike or at the very least call for an end to the BoE’s asset purchase program.

2. BoE Raises Growth Forecasts for 2017

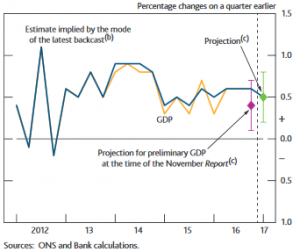

The central bank’s MPC gave an upgraded view of the economy for 2017, raising growth forecasts from 1.4% to 2.0% including lifting its growth projections for 2018 and 2019. Growth is expected to slow to 1.8% in 2018 and then fall to 1.6% by 2019, according to the estimates.

Output growth and bank staff’s projections (Source: BoE)

However, the central bank left inflation forecasts unchanged expecting inflation to run above 2% until 2020. The British pound is down 20% since the pre-Brexit levels but managed to bounce off the lows. The central bank expects the exchange rate weakness to propel inflation higher and expects an overshoot to as much as 2.7%.

Leave A Comment