Image source: Pixabay

Image source: Pixabay

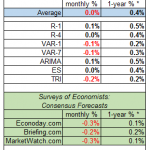

This morning gives us the latest inflation update (more below) and, as we have been discussing, it will provide another data point for market soothsayers to help predict the timing of the Fed’s next easing cycle. For the Fed, it will be one of the last pieces of data collected before they begin their March policy meeting next week. Several weeks ago, Fed Chair Powell telegraphed a March rate cut was off the table, but this will be one of those meetings after which the central bank shares its updated Economic Projections, including GDP and inflation forecasts for 2024. While both are expected to inch higher compared to their December figures, the degree of those revisions could push rate cut expectations, which have been slipping toward 3Q 2024 decidedly into that quarter.Forecasts are calling for the top-line February CPI figure to come in even with January’s reading of 3.10% while the core figure (CPI ex-Food & Energy) is expected to have dropped slightly from 3.90% to 3.70%. To set the stage for the February data, the only Core item that dropped in the January YoY release was Used Cars & Trucks (-3.50%) while Shelter (6.00%), Tobacco and Smoking Products (7.40%), and Transportation Services(9.50%) led category gains. We’d also note data from AAA that shows the national average for gas rose $0.19 per gallon in February after falling between September and January. Last night, the Fed funds Futures curve showed traders pricing in a roughly 55% chance of a 25 basis point cut at the June meeting and a combined 80% chance of at least a 25 basis point cut by July. Essentially, numbers coming in significantly lower than expectations could help move timing expectations forward, and evidence that inflation is running hotter will push those estimates out. The question for us is how traders will react to this February CPI findings vis-a-vis more profit-taking, as we’ve seen in recent days, or if it will it embolden them to once again “buy the dip”.Early this morning, we learned the NFIB Small Business Optimism Index edged down to 89.4 in February, the lowest in nine months, from 89.9 in January, and below forecasts of 90.7. Twenty-three percent of small business owners reported that inflation was their single most important business problem in operating their business, up three points from last month, and replacing labor quality as the top problem.More By This Author:Waiting For February Inflation DataWill The February Employment Report Support The Current Market Narrative? Powell Says Fed Funds Rate At Its ‘Peak’ But…

Leave A Comment