Last week, the Fed held a two-day meeting followed by a press conference. The statement they released was not a rosy one. In fact, the Fed economic outlook is nothing to be happy about.

Most of the meeting contained zero surprises. The committee did as the market expected; they raised the Fed Funds rate by 1/4 point to 1.5 – 1.75% to normalize short-term rates after the catastrophic financial crisis. It is continuing to reduce its bloated balance sheet, which is chock full of Treasury securities and other long-term bonds.

The statement that was issued during the press conference expressed some hawkish sentiment. This came as no surprise. After all, the Fed is tightening a very loose policy until it reaches a neutral level of 2.75 – 3%.

While the statement was rather bland, the press conference took on a different flavor. Chair Powell was very matter of fact. He seems to be a straight-shooter who won’t be led “to and fro” by the markets and knows how to play his cards. I think the market might need to adjust to a different delivery style, knowing full well monetary policy won’t be changing anytime soon.

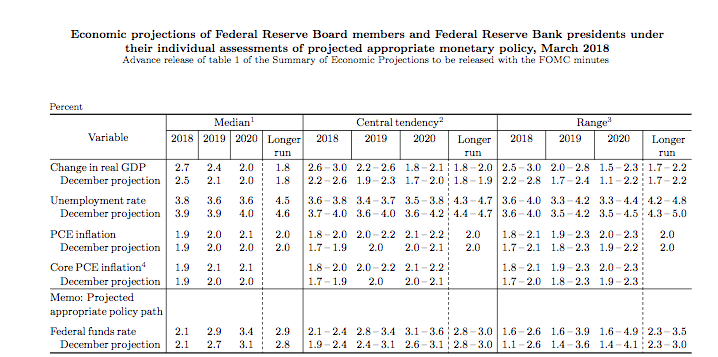

I did find the Fed economic outlook troubling, which changed quite a bit from December’s numbers. See the chart below. What stands out to me is the progressive reduction in growth expectations, from 2.7% in 2018 to 2.4% in 2019 to 2% in 2020. Further, inflation barely budged from December (it was up a whopping 0.1%), yet Fed Funds zoom up dramatically in the outer years. This does not make sense. The Fed Funds rate should be rising past neutral ONLY if inflation expectations are out of control.

Of course, these projections are just guesses. There is no hard evidence to support them, and they will change as the economy moves along. Policy can be swayed by the influence of the Fed economic outlook, and if it is correct, that means some of the brightest economists see dark days on the horizon. Let’s hope we have a better outcome.

Leave A Comment