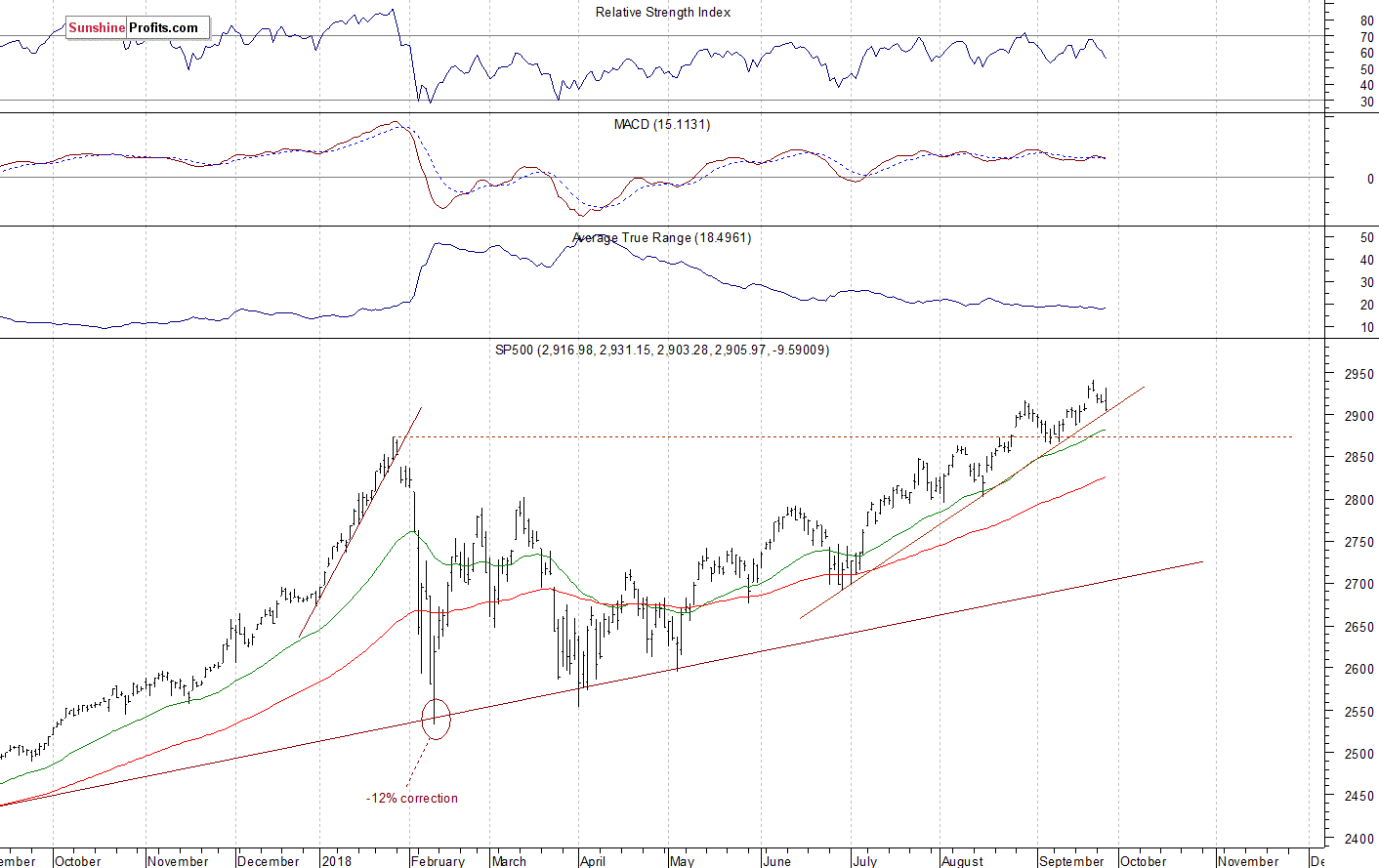

The U.S. stock market indexes lost 0.2-0.4% on Wednesday, as investors reacted to the FOMC’s Interest Rate hike announcement. The S&P 500 index has reached the new record high of 2,940.91 on Friday. It currently trades 1.1% below that high. The Dow Jones Industrial Average lost 0.4% and the technology Nasdaq Composite lost 0.2% yesterday.

The nearest important level of support of the S&P 500 index is now at 2,900. The market fell below its last Thursday’s daily gap up of 2,912.36-2,919.73 yesterday. The support level is also at 2,885-2,890, marked by the recent local lows. On the other hand, the nearest important level of resistance remains at around 2,920-2,930, marked by Monday’s daily gap down of 2,923.79-2,927.11. The resistance level is also at 2,940, marked by the record high.

The broad stock market reached the new record high last week, as the S&P 500 index extended its short-term uptrend above the level of 2,900. Will it continue higher despite some short-term technical overbought conditions? The index is at its three-month-long upward trend line following yesterday’s intraday reversal, as we can see on the daily chart:

New Downtrend or Just Correction?

The index futures contracts are trading between +0.1% and +0.3% vs. their Wednesday’s closing prices. So expectations before the opening of today’s trading session are slightly positive. The main European stock market indexes have been mixed so far. Investors will wait for the series of economic data announcements this morning: Durable Goods Orders, Final GDP q/q number, Wholesale Inventories, Initial Claims at 8:30 a.m., Pending Home Sales at 10:00 a.m. The broad stock market will likely remain within a short-term consolidation along the level of 2,900. The index is close to its late August local high. However, if the S&P 500 breaks lower, we could see more selling pressure. For now, it looks like just another correction within an uptrend.

Leave A Comment