Last week, the Federal Reserve released the results of supervisory bank stress tests. What do they mean for the gold market?

According to the results of supervisory stress tests released Thursday by the Federal Reserve Board, the U.S. largest banks (with $50 billion or more in total consolidated assets) would “retain their ability to lend to households and businesses during a severe recession”, thanks to the build-up of capital after the financial crisis. Actually, all 34 institutions passed Fed’s stress tests for the first time in seven years.

Unfortunately, it is bad news for the gold market. Surely, the surprisingly good banks’ performance may partially results from the eased supervisor’s stance (this time, the Fed dropped some of the toughest components of the tests), but it does not matter. What really counts is that the positive results freed $120 billion of banks’ capital. Unsurprisingly, they promptly announced plans to boost dividends and stock buybacks.

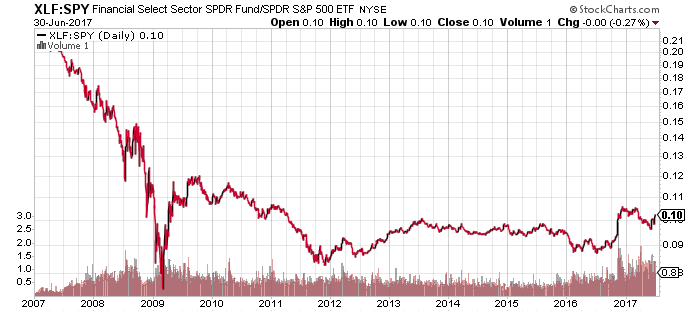

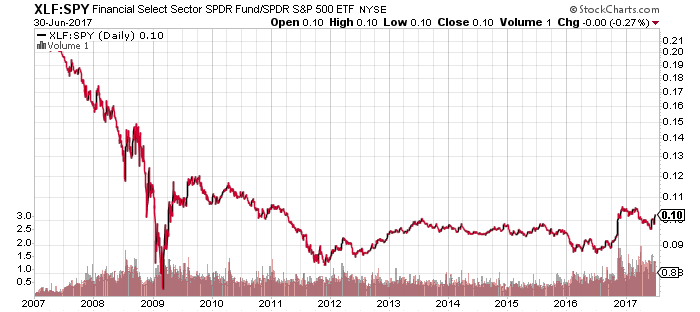

Hence, last Thursday may be a turning point for the banking sector, especially that the bank stocks still look undervalued. As one can see in the chart below, the financial sector did not regain its market share after the financial crisis.

Chart 1: U.S. Financial Sector’s (XLF) performance compared to the S&P 500 over the last 10 years.

Source: stockcharts.com

Since the banking sector is an important fundamental driver of gold prices (the yellow metal shines during banking crises and financial turmoil), rising confidence in the banking system may be another significant headwind for the price of gold.

To sum up, the Fed released on Thursday the results of supervisory bank stress tests. The U.S. large banks passed them surprisingly well, which is negative news for gold. The positive results imply that the banks can use some of their capital for dividends and stock buybacks. This may attract the investors’ attention and prone them to shift their funds from save havens such as gold and invest them in bank stocks, which suddenly look more attractive.

Leave A Comment