In October, the Federal Reserve started the unwinding of its massive balance sheet. According to the addendum to the Policy Normalization Principles and Plans revealed in June 2017, Fed officials wanted to reduce the size of its security portfolio by $10 billion in October ($6 billion in Treasuries and $4 billion in the mortgage-backed assets). Let’s analyze whether this is really what happened, how the so-called quantitative tightening has influenced the financial markets so far, and what the Fed’s normalization would mean for the gold market.

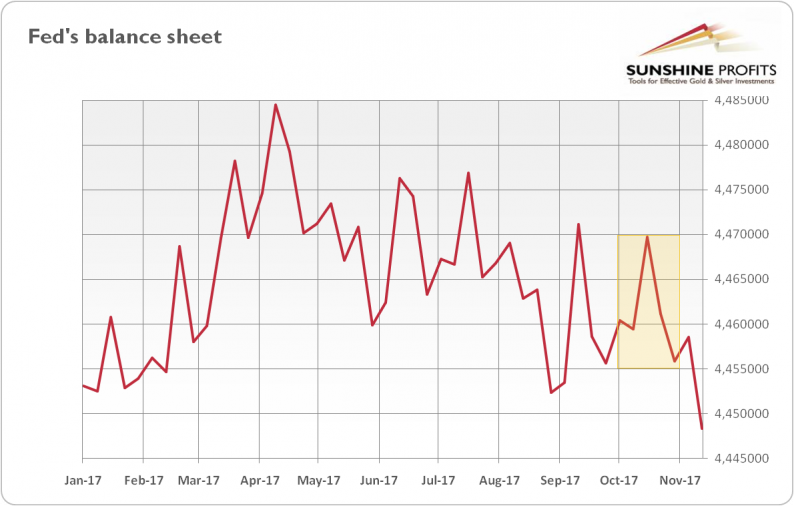

As for the first question, data shows that the U.S. central bank actually failed to reduce its balance sheet by $10 billion. Instead, the Fed’s balance sheet on September 27 amounted to $4,455,661 million, while on November 1 it was $4,455,887, as the chart below shows. So the U.S. central bank’s assets actually slightly increased on October!

Chart 1: Fed’s balance sheet from January to November 2017.

When it comes to the second question, the financial markets did not react significantly in response to the quantitative tightening, just as we predicted in the May edition of the gold market. Actually, the U.S. stock market calmly set more records in October, shrugging off the Fed’s historical move.

Why was that? As we have pointed out several times, there are a few important reasons. First, the unwinding of the Fed’s balance sheet was well telegraphed in advance and thus widely expected by the markets. Second, the pace of tightening will be gradual. Third, the U.S. central bank will not reduce its balance sheet to the pre-crisis level.

However, there is another thing we already mentioned at the beginning. The data shows that the Fed started to reduce the size of its securities portfolio, but simultaneously it also began to cut the size of its reverse repurchase agreements (the Fed’s sales of securities with an agreement to repurchase them later). The former reduces the liquidity in the banking system, while the latter increased it. Indeed, the so-called excess reserves in the U.S. banking system rose by almost $140 billion between September 27 and November 8. It implies that the Fed wants to unwind its balance sheet in such a manner that will not add pressure on bank reserves.

Leave A Comment