Amid a relentless barrage of doom and gloom – and then some more doom for good measure – establishment forecasts about the future of cryptocurrencies, including everyone from Goldman, to the BIS, to the World Bank, all of which have been some iteration on how cryptos have no future, this morning an unexpectedly objective and somber view on the future of bitcoin came from none other than the organization that prints (out of thin air) the nemesis to bitcoin: the Federal Reserve.

While the emphasis of the Q&A with New York Fed economists Michael Lee and Antoine Martin, which we have republished below, is the issue of “trust” and how it defines monetary exchange, there are several things that attracted our attention.

The first is the Fed’s take on what we have been saying since 2015, and the reason behind bitcoin’s original surge in 2015/2016, namely its use for illicit purposes:

The Drug Enforcement Administration reports a sharp decline in bulk cash smuggling in 2016, which is the traditional payment method for drug shipments and suggests that payments may have shifted toward cryptocurrencies. Cryptocurrencies are more convenient than cash for many illegal activities that now take place online.

… cryptocurrencies are ideal for circumventing legal or regulatory authorities, because they aren’t governed by any. China, which actively controls capital flow, banned banks from dealing with bitcoin in 2013 (this was relaxed later), because it was thought to be used for money laundering. North Korea is reportedly responsible for state-sponsored hacks to steal cryptocurrencies, which help bypass economic sanctions that are enforced through the cooperation of financial institutions and countries.

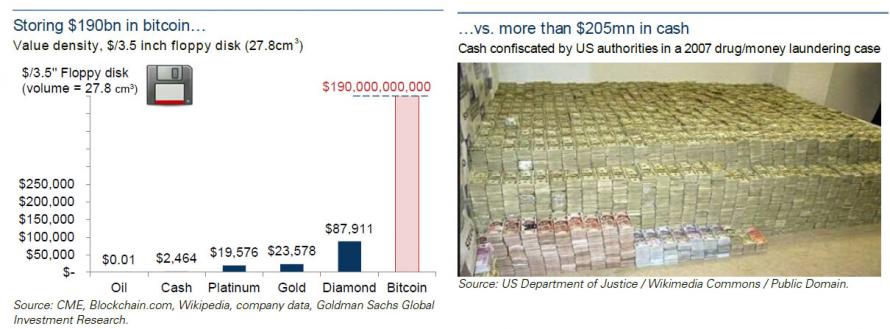

This – the ability to hide and store dramatic amount of wealth in a tiny space – is also the reason why according to Goldman cryptocurrencies are really cryptocommodities, as they are not backed by a monetary authority like the Fed. This what Goldman said earlier this week: “Unlike other storage commodities like oil, gold, platinum, diamonds, and even cash, there is no need to hold much physical material to own bitcoin; even a technology as obsolete as the 3½ inch floppy disk can hold almost 30,000 private keys. There is no theoretical upper limit to the value of bitcoins in a wallet, but if we assume each wallet secured by this disk contains as much as the largest wallet today (180,000 BTC), this single disk could “hold” all bitcoins in existence and remain less than 0.5% full. Assuming a bitcoin market cap of roughly $190bn (as of late January), this disk would be the equivalent to either: 95% of the 4,583 tons of gold in Fort Knox, or 1,344 Very Large Crude Carrier supertankers of oil.”

Next follows an exchange that many opponents of bitcoin have been leery to engage in, namely why does cryptos have value if they aren’t backed by anything. The Fed’s response – the admission that the dollar is in the same boat thanks to Nixon – is needless to say , surprising.

Q. If virtual currencies aren’t backed by anything real, gold or some other physical commodity, does that mean they all eventually will be worthless?

A. You’re right that they are not backed by a physical commodity, but then neither is the dollar and most other modern currencies. It’s long been known that currencies that are intrinsically worthless, mere pieces of paper, are recognized as valuable because payments with money are so much easier than the alternative, barter. The problem with barter, when everyone trades goods and services directly, is the dreaded “double coincidence of wants.” If I want to have dinner at my favorite restaurant but the cook is not interested in trading a meal for a bitcoin lecture, I have to keeping searching until I find a restaurant that I like where, coincidentally, the cook can’t hear enough about bitcoin.

Money, even intrinsically worthless paper money, cuts the “double coincidence” problem in half. I just need to find someone willing to pay me some of that paper for my lecture, then use that paper to pay for dinner. As long as I trust that someone will accept the paper, I’m willing to accept it in exchange for my lecture. It’s trust that the “worthless” piece of paper is actually worth something to other people that makes it an acceptable medium of exchange.

As a result, the price of bitcoin fluctuates with news that vendors or firms accept or decline bitcoin as a mode of payment. Late last year, bitcoin prices jumped after Square, a payments firm, was reported to be testing bitcoin. Wider adoption and acceptance of cryptocurrencies as a payment option naturally increases what they are worth.

![Insight On The Available Options For Dealing With Debt [US]](https://www.riceoweek.com/wp-content/uploads/2018/04/sorry-image-not-available-150x150.jpg)

Leave A Comment