A 28% reduction!

That’s how much the Atlanta Fed chopped off their GDP forecast for Q1 after getting a look at yesterday’s Personal Consumption and Expenditures data. The forecast is now for an anemic 1.8% growth and the market is up 13% since last Q so traders are currently paying 700% for growth at these prices – really smart…

The market gapped up the next morning when the Fed put out a 3.4% estimate on Jan 31st (reports are end of day) so will they gap down now that we have reversed the move off the 2.25% base-line estimate? Not only are the economic outlooks collapsing but more and more Fed Governors are telegraphing a March 15th rate hike with Lael Brainard, one of the top Fed doves, saying last night that the Fed should raise rates “soon

.”

The Fed HAS to raise rates or we risk a worst-case economic situation – a stagnant economy plus inflation or STAGFLATION – a trap the Fed really needs to keep us out of. Inflation already looks poised to get out of control thanks in large part to our friends at OPEC (and in the White House) artificially pushing up the price of oil, which is a stealth tax on consumers, draining their discretionary spending accounts.

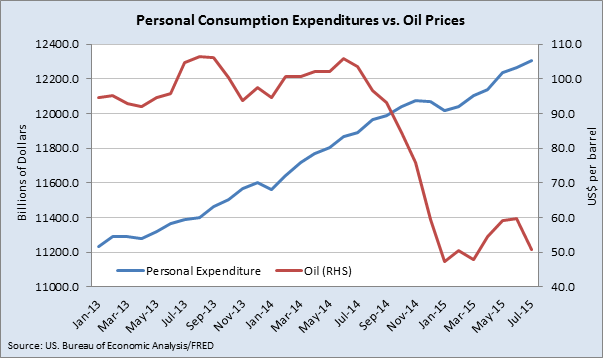

I don’t have a more recent graph but, as you can see, the resurgence of the US Consumer in the past couple of years has been a direct result of oil prices going from $100 to $40 and now we’re back at $53 (up 33%) already, erasing 20% of the drop in prices. Will we also erase 20% of the 120% gain in Personal Consumption – early indications noted by the Atlanta Fed say yes – that’s why they chopped 28% off their GDP forecast.

Speaking of oil – we’re keeping ahead of inflation with very nice $1,000 per contract gains from yesterday’s Live Trading Webinar on our Oil Futures (/CL) position – now at goal at $53 so don’t be greedy and at least 1/2 off the table with right stops ($53.25) on the remainder. Any time you make $1,000 per contract in less than 24 hours, you need to learn to be happy to cash in!

Leave A Comment