Health care services stocks have outperformed the broad market since 2014.

Mutual funds and ETFs focusing on health care services Fidelity Select Medical Delivery Portfolio (FSHCX), iShares U.S. Healthcare Providers (IHF), and SPDR S&P Health Care Services (XHS) have risen over 37% from the start of 2014 through September 18, 2015. The S&P 500 is up 9% during the same period.

Health care services investments have benefited from the Affordable Care Act (ACA) as well as heightened merger & acquisition activity. The population without health insurance has declined since healthcare providers phased in the ACA’s major provisions in 2014. According to Gallup, the uninsured rate among U. S. adults dropped to 11.4% in the second quarter of 2015 from 18.0% in the third quarter of 2013.

As a result, health insurers like Anthem (ANTM) and UnitedHealth Group (UNH) have prospered from premium growth through addition of new members. Hospitals like HCA Holdings (HCA) have benefited from a decline in expenses in caring for the uninsured while pharmacy benefit managers like Express Scripts (ESRX) have profited from higher sales for prescription drugs.

Healthcare providers have been notably active on the M&A front to stay competitive. They are seeking deals to lower costs by achieving scale economies and greater bargaining power. Healthcare companies that derive significant business from government programs like Medicare and Medicaid have become coveted takeover targets as others seek to enter or expand such business lines.

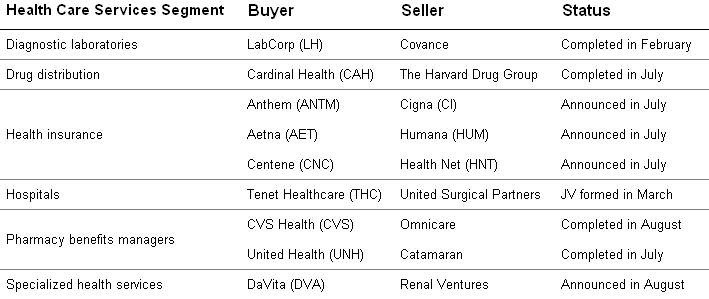

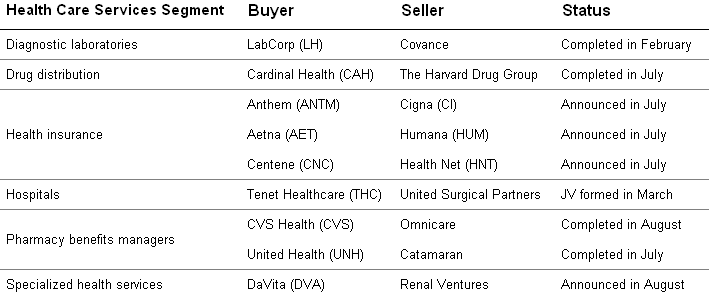

Here is a list of M&A activity that is reshaping the health care services industry:

Representative Deal Activity in Health Care Services in 2015

What’s Ahead for Fidelity Select Medical Delivery and Health Care Services ETFs

In the near-term, investor attention is likely to center on enrollment trends and merger-related developments.

The third year of enrollment via health care exchanges opens on November 1.

On the M&A front, there is measurable risk of regulatory hurdles derailing the proposed Anthem-Cigna (CI) and Aetna (AET)-Humana (HUM) mergers. For one, doctors, hospitals, and consumer groups oppose these transactions.

Going forward, companies seeking growth through acquisitions are likely to focus on smaller targets regardless of how the proposed mega mergers pan out.

The health care services industry is poised to evolve further under the ACA. The resulting impact of business opportunities and challenges on earnings and earnings growth should be key drivers of stock prices over the long-term.

Increasing enrollment in Medicare Advantage plans, the privately run version of the government’s Medicare insurance program should result in additional opportunities for health insurers as well as care providers.

The increasing role of data, technology, and preventive care in providing health insurance should open opportunities for health care information services companies like Cerner (CERN).

As for challenges, insurance exchanges render comparison-shopping easier. As such, health insurers may have to cope with a more competitive environment. The ACA also imposes restrictions on underwriting exclusions and pushes insurers to manage medical costs through cost control mechanisms.

As seen from the table below, analysts currently expect health care services companies to grow EPS by 13.2% in 2016 after increasing it 12.6% in 2015.

Leave A Comment