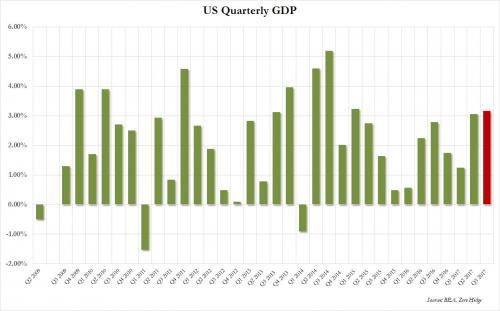

In the third and final estimate of Q3 GDP, the US economy eased back fractionally from last month’s “hot” 3.3% print, and as a result of a modest decline in Personal Consumption from 1.60% to 1.49% (in the GDP calculation) as well as net trade, the final GDP print came in at 3.2%, down slightly from last month’s and consensus estimate 3.3%, which however was still the highest GDP print since Q1 2015, when the economy grew at a 3.23% pace.

The increase in real GDP reflected increases in consumer spending, inventory investment, business investment, and exports. Imports, which are a subtraction from GDP, decreased. The increase in consumer spending reflected increases in spending on both goods and services. The increase in goods was primarily attributable to motor vehicles. The increase in services primarily reflected increases in health care, financial services and insurance, and food services and accommodations.

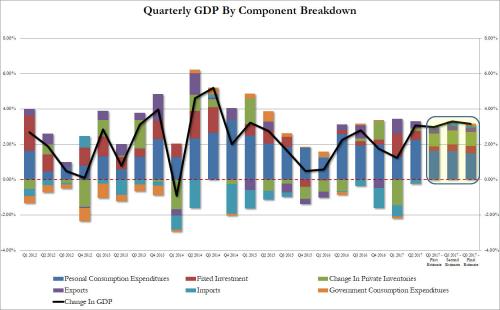

Putting numbers to the data, final Q3 Consumer Expenditures were revised modestly lower, from contributing 1.60% to the bottom line GDP, to 1.49%. This however was offset by an upward revision to Fixed Investment (from 0.39% to 0.40%) while Private Inventories was marginally lower (0.80% to 0.79%); net trade was also reduced fractionally (from 0.44% to 0.36%) and finally, government consumption, rose once again from 0.07% to 0.12%.

Some other numbers:

Also notable in today’s release was the Corporate Profits number, which surged at a 4.3% annual rate in Q3, after increasing 0.7 percent in the second quarter.

Leave A Comment