Did you know that there are more than 1.8 trillion dollars worth of junk bonds outstanding in the United States alone? With interest rates at record lows all over the world in recent years, investors that were starving for a decent return poured hundreds of billions of dollars into high yield debt (also known as junk bonds). This created a giant bubble, but at first everything seemed to be going fine. Defaults were very low and most investors were seeing a nice return. But then the price of oil started crashing and the global economy began to slow down significantly. Energy company debt makes up somewhere between 15 and 20 percent of the junk bond market, and the credit rating downgrades for that sector are coming fast and furious. But it isn’t just the energy industry that is seeing a massive wave of defaults, debt restructurings and bankruptcy filings. Just like with subprime mortgages in 2008, investors are starting to wake up and realize that the paper that they are holding is not worth a whole lot. So now investors are rushing for the exits and we are starting to see panic on a level that we have not witnessed since the last financial crisis.

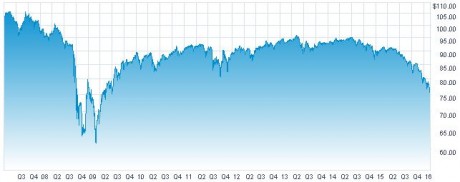

Just look at what has been happening in recent days. Investors took nearly 500 million dollars out of the largest junk bond ETF (iShares HYG) last week alone. The following chart shows that HYG has now fallen to the lowest level that it has been since the last financial crisis…

During the last financial crisis, junk bonds starting crashing well before stocks did. In fact, many consider junk bonds to be a sort of “early warning system” for stocks. For many analysts, when you see high yield debt collapse that is a huge warning sign that you need to get out of stocks as soon as possible.

And this makes perfect sense. When financial trouble erupts, it is going to hit more vulnerable companies first usually.

Blue chip companies are typically not in the high yield debt market. Normally, high yield debt is only for companies that have more risk associated with them. And it is risky companies that typically start to crumble the quickest.

Leave A Comment