Introduction

In a recent reading of Validea’s Guru Investor Blog, a quote from Georgetown University finance professor James Angel struck home to me: “One of the open secrets of the financial-services world is that we’re also in the entertainment and gaming industry.” In order to see why the analogy fits, it is worth looking at the structure of the financial services industry. In the following, we look at the managers, their clients, and the mangers’ marketing approaches.

The Managers

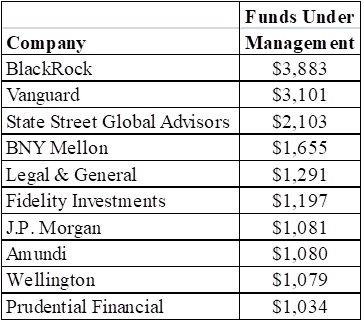

Pensions and Investments (P&I) surveyed 565 financial managers. They found they are managing just under $68 trillion. And as Table 1 indicates, each of the top ten is managing at least $1 trillion.

Table 1. – The Largest Global Money Managers

Source: Pensions and Investments (P&I)

The Target Markets

A good portion of these funds are being managed, directly or indirectly on behalf of individuals. Table 2 presents data on the assets and liabilities of US households. Households own directly almost $18 trillion. They decide how to invest these funds. They might have advisors, pick stocks individually or buy mutual funds or exchange-traded funds. In the case of their pensions, mutual funds and insurance, they defer to others to make specific investment decisions for them.

Table 2. US Households Assets and Liabilities, 2018 (bil. US$)

Source: Federal Reserve Flow of Funds Data

Individuals have $23 trillion in pension claims but Table 2 indicates they only have $19 trillion in “funded pension assets.” So how do pensions invest their monies? Most pension funds take steps to avoid direct liability, so they create investment committees. These committees also want to deflect direct responsibility, so they hire recognized advisors. These advisors do not decide how to invest their monies. Instead, they again deflect responsibility by recommending managers and the sorts of investments the managers should make.

Leave A Comment