The bulls are putting together, in the premarket at least, the makings of a bounce. If the early morning strength can hold, and improve matters technically, I’ll be a buyer.

Indicators

VIX – stocks have dropped a measly 1.5 points on SPX over the last two days. During that same time span, the VIX has fallen 15.2%.

T2108 (% of stocks trading below their 40-day moving average) – Breadth has been horrible in the market of late. Only 31% of stocks are trading above their 40-day moving average.

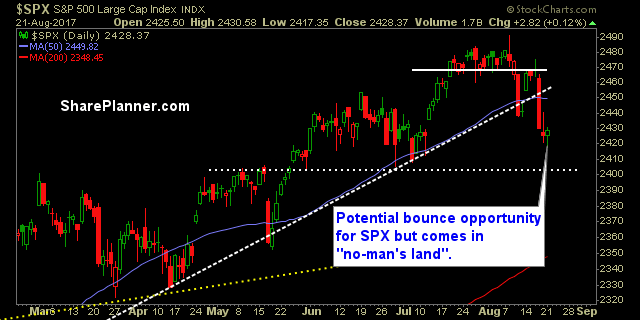

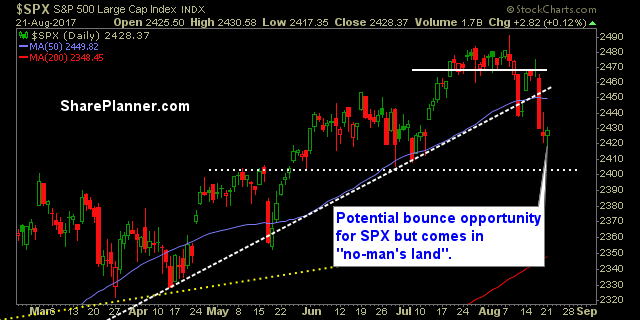

Moving averages (SPX): No changes in the MA’s. With the price action below all the short-term MA’s, there is a real chance that the S&P 500 tests the 200-day MA eventually.

Industries to Watch Today

Financials showing strength in the pre-market, Tech looks ready to rally as well.

My Market Sentiment

The potential for a bounce is much more real following yesterday’s bounce in the last 45 minutes of trading. If the bears are going to keep themselves from getting squeezed yet again, they’ll need to squash any bounce attempt today.

Large caps > Small caps.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance:

Recent Stock Trade Notables:

Leave A Comment