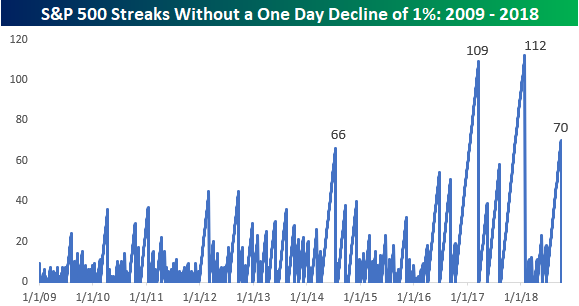

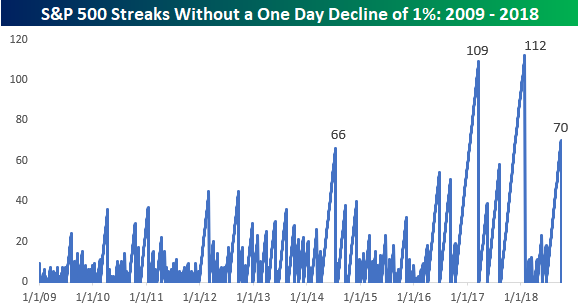

The S&P 500 is currently trading down just over 1%, and if these declines hold through the closing bell, it would be the first decline of 1% or more for the index since late June. At 70 trading days, the current streak ranks as the third longest of the bull market behind the 109 trading day streak that ended in March 2017 and the 112 trading day streak that ended earlier this year. Besides those two streaks, the only other streak that was nearly as long was the one that ended in July 2014 at 66 trading days.

While the current streak of days without a 1% decline is long relative to recent history, from a wider lens, there have been a number of streaks that lasted longer. The chart below shows all S&P 500 streaks without a 1% decline in the S&P’s history. In the post-WWII period, there have actually been 24 streaks that lasted longer with the bulk of those coming in the 1950s/1960s. The longest streak ended in November 1963 at 174 trading days. Considering how painful the decline feels today, can you imagine how bad it felt in 1963 when the S&P 500 finally declined more than 1% after going eight months without one?

Leave A Comment