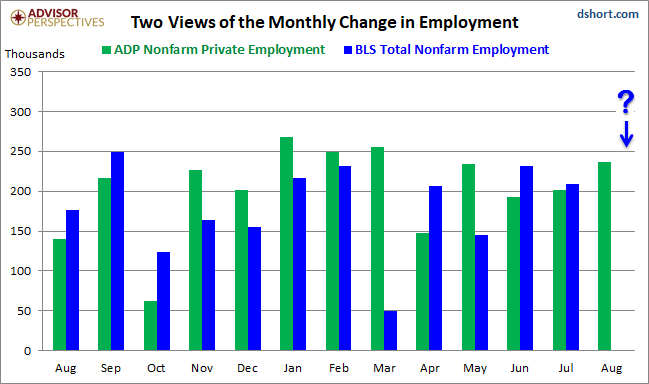

The economic mover and shaker this week is Friday’s employment report from the Bureau of Labor Statistics. This monthly report contains a wealth of data for economists, the most publicized being the month-over-month change in Total Nonfarm Employment (the PAYEMS series in the FRED repository). Today we have the ADP August estimate of 237K new nonfarm private employment jobs, an increase over July’s 201K, which was an upward revision of 23K.

The 237K estimate came in above the Investing.com consensus of 183K for the ADP number.

The Investing.com forecast for the forthcoming BLS report is for 180K nonfarm new jobs (the actual PAYEMS number) and the unemployment rate to remain at 4.3%.

Here is an excerpt from today’s ADP report:

“In August, the goods-producing sector saw the best performance in months with solid increases in both construction and manufacturing,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Additionally, the trade industry pulled ahead to lead job gains across all industries, adding the most jobs it has seen since the end of 2016. This could be an industry to watch as consumer spending and wage growth improves.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market continues to power forward. Job creation is strong across nearly all industries, company sizes. Mounting labor shortages are set to get much worse. The initial BLS employment estimate is often very weak in August due to measurement problems, and is subsequently revised higher. The ADP number is not impacted by those problems.”

Here is a visualization of the two series over the previous twelve months.

The key difference between the two series is that the BLS series is for Nonfarm Payrolls while ADP tracks private employment.

Leave A Comment