The annual “In Gold We Trust” report by Liechtenstein-based investment firm Incrementum is a must-read account of the gold market, and its just-released chartbook for the 2018 edition is no exception.

The strengthening U.S. dollar has lately dented the price of gold, and rising interest rates are making some yield-bearing financial assets more attractive as a safe haven. But as Incrementum shows, there are many risks right now that favor owning gold in your portfolio.

Below I’ve selected five of the most compelling charts that highlight why I think you need gold in your portfolio now.

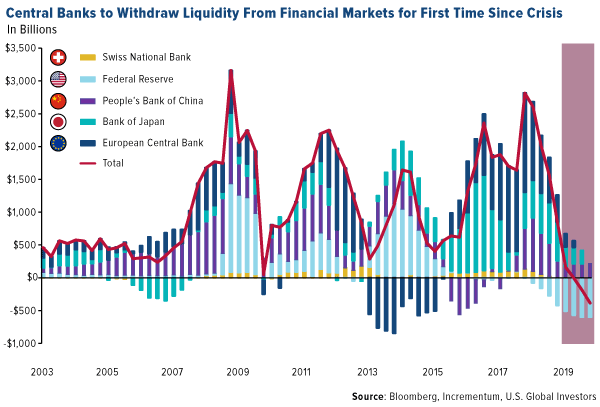

1. The End of Easy Money

To offset the effects of the global financial crisis a decade ago, central banks increased liquidity by slashing interest rates and buying trillions of dollars’ worth of government securities. Now, however, it looks as though banks are ready to start tightening, and no one is really quite sure what the consequences will be. The Federal Reserve was the first, in late 2015, to begin hiking rates, and it’s been steadily shrinking its balance sheet for about a year now. Other banks are set to follow suit. According to Incrementum, the tide will turn sometime next year, with global liquidity finally set to turn negative. In the past, recessions and bear markets were preceded by central bank tightening cycles, so it might be a good idea to consider adding gold and gold stocks, which have historically done well in times of economic and financial turmoil.

2. Banks on a Gold-Buying Spree

While I’m on this subject, central banks have been net purchasers of gold since 2010, with China, Russia, Turkey and India responsible for much of the activity. Just this week, I shared with you the news that Poland added as much as nine metric tons to its reserves this past summer. If gold is such a “barbarous relic,” why are they doing this? As Incrementum writes, “The increase in gold reserves should be seen as strong evidence of growing distrust in the dominance of the U.S. dollar and the global monetary system associated with it.” Having a 10 percent weighting in gold and gold stocks could likewise help you diversify away from fiat currencies and monetary policy.

Leave A Comment