Judging by reactions in the crude oil market, last week’s OPEC announcement exceeded expectations. Beyond an extension until the end of 2018, OPEC surprised many by including Libya and Nigeria as part of the cartel’s production limits. Despite earlier rumors regarding Russian reluctance, the country agreed with Saudi Arabia’s push for an extension following King Salman’s landmark visit to Russia earlier this year. Now that OPEC is in the rear view mirror, markets will return to focusing on US crude oil production as well as speculator positioning in the commodity.

Bull market remains intact, but US supply remains worrisome

As demand growth remains higher than supply growth, the bull market in crude oil remains fundamentally supported. As discussed in a previous commentary, looking at demand versus supply growth in rate-of-change terms is a good way to determine the fundamental trend driving crude oil prices. The latest data from a variety of sources including the International Energy Agency suggests that demand continues to grow ahead of supply. Our technical trending indicatorshave also identified a bullish trend in crude oil prices, in both the short-term and the medium-term. Thus the bull market is likely to continue.

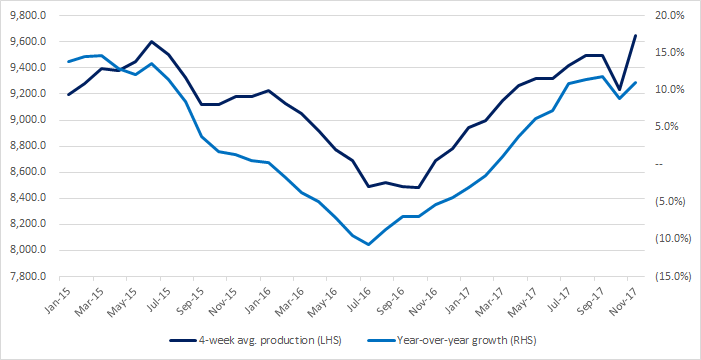

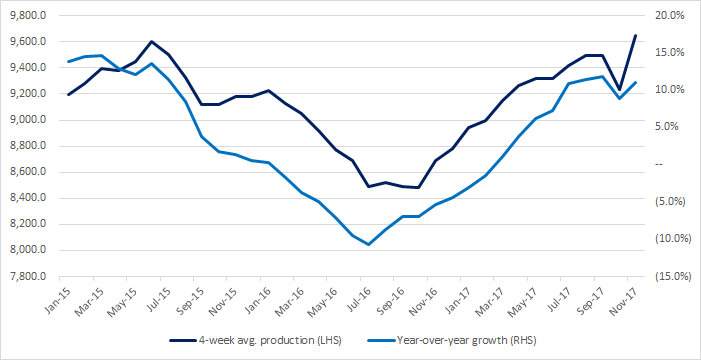

The main threat to the fundamental story today is rising US production. A day before the OPEC announcement, data from the US Energy Information Administration showed that US production is at all-time highs. A visual overview of US production and year-over-year growth is shown below:

Drill baby drill: US supply comes roaring back

Source: US Energy Information Administration

As can be seen from the data, US supply is currently growing in excess of 10% per year. US production is especially impressive given healthy output numbers at this time last year. Mathematically, year-over-year growth tends to slow as the denominator gets larger (i.e. the ‘base effect’). Much to OPEC’s annoyance, the base effect hasn’t slowed down US shale this year.

Leave A Comment