The Federal Open Market Committee’s (FOMC) first interest rate decision for 2018 may generate a limited reaction as Chair Janet Yellen and Co. are expected to retain the current policy, but the fresh batch of central bank rhetoric may heighten the appeal of the greenback should Fed officials show a greater willingness to lift the benchmark interest rate over the coming months.

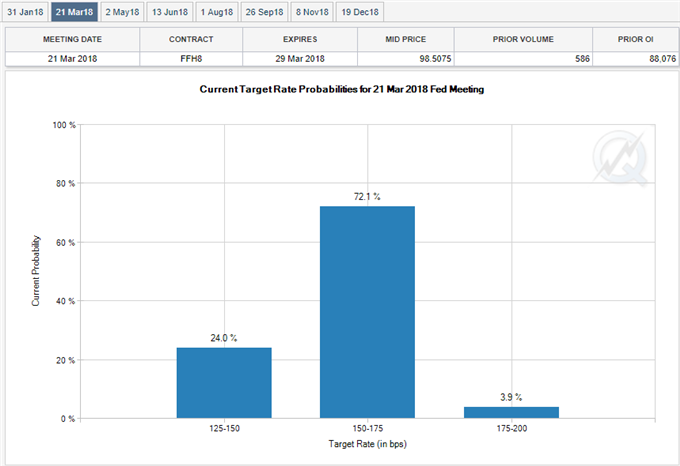

With Fed Fund Futures still highlighting a greater than 70% probability for a move at the March meeting, the committee may utilize Chair Yellen’s last meeting to prepare U.S. households and businesses for an imminent rate-hike as ‘many indicated that they expected cyclical pressures associated with a tightening labor market to show through to higher inflation over the medium term.

In turn, a hawkish policy statement may rattle the near-term rally in EUR/USD, but more of the same from the FOMC may keep the euro-dollar exchange rate afloat as market participants scale back bets for three Fed rate-hikes in 2018.

Impact that the FOMC rate decision has had on EUR/USD during the previous meeting

Period

Data Released

Estimate

Actual

Pips Change

(1 Hour post event )

Pips Change

(End of Day post event)

DEC

2017

12/13/2017 19:00 GMT

1.25% to 1.50%

1.25% to 1.50%

+45

+53

December 2017 Federal Open Market Committee (FOMC) Interest Rate Decision

EUR/USD 15-Minute Chart

As expected, the Federal Open Market Committee (FOMC) delivered a 25bp rate-hike at its last meeting for 2017 to lift the benchmark interest rate to a fresh threshold of 1.25% to 1.50%. At the same time, the fresh forecasts from Fed officials suggest the central bank will also implement three rate-hikes in 2018 as ‘the Committee expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate,’ while the longer-fun forecast was largely unchanged amid projections for a terminal rate around 2.75% to 3.00%.

Leave A Comment