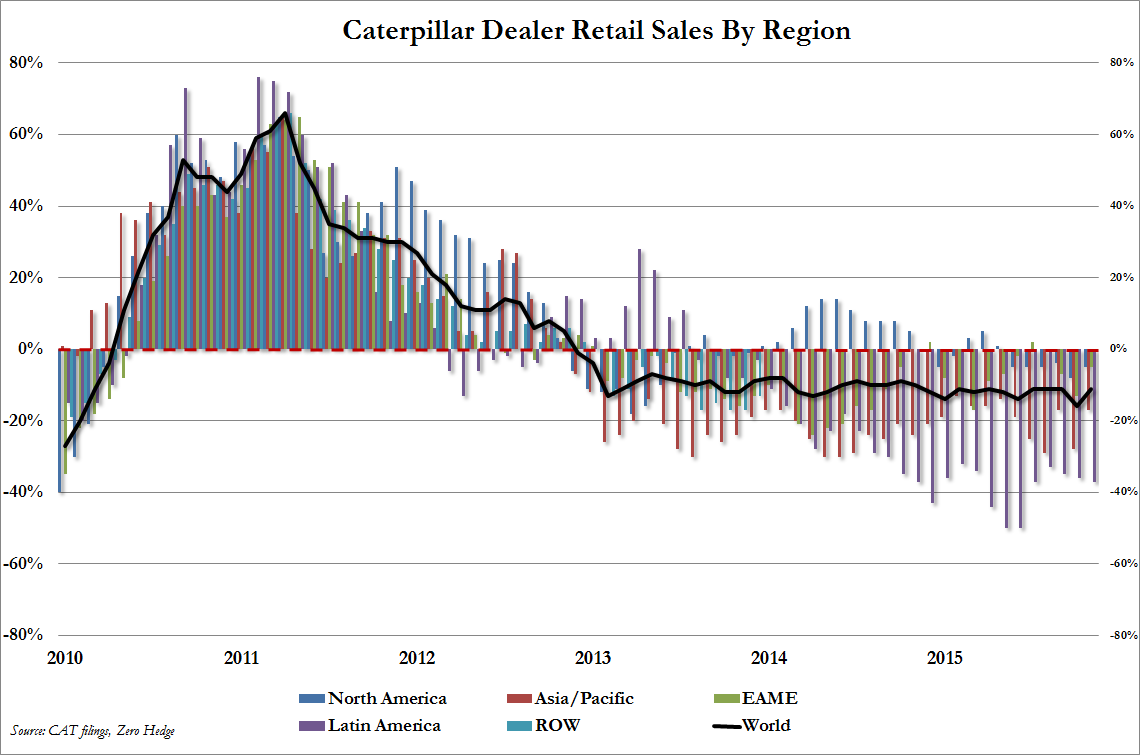

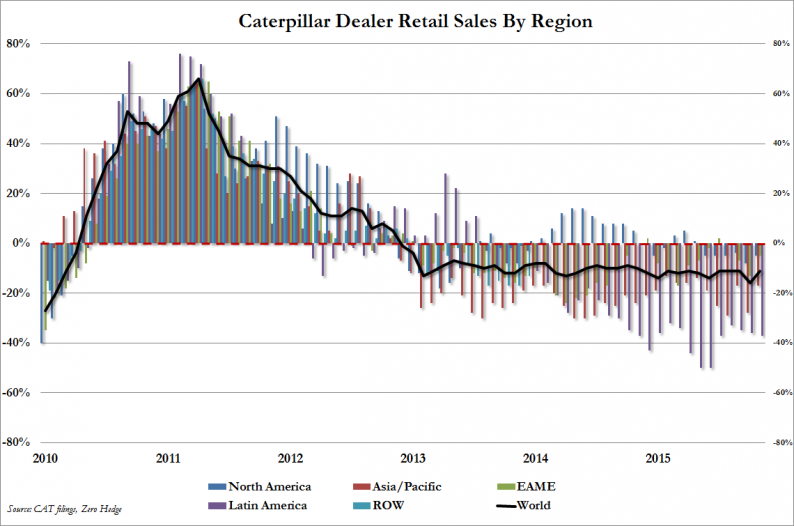

Earlier today Caterpillar reported its latest monthly retail sales statistics, and the numbers continue their deplorable trend: Asia/Pacific (mostly China) was down -17%,EAME dropping -5%, Latin America down -37%, the US down -5%, and global sales continuing their double digit decline for one more month down -11% in November.

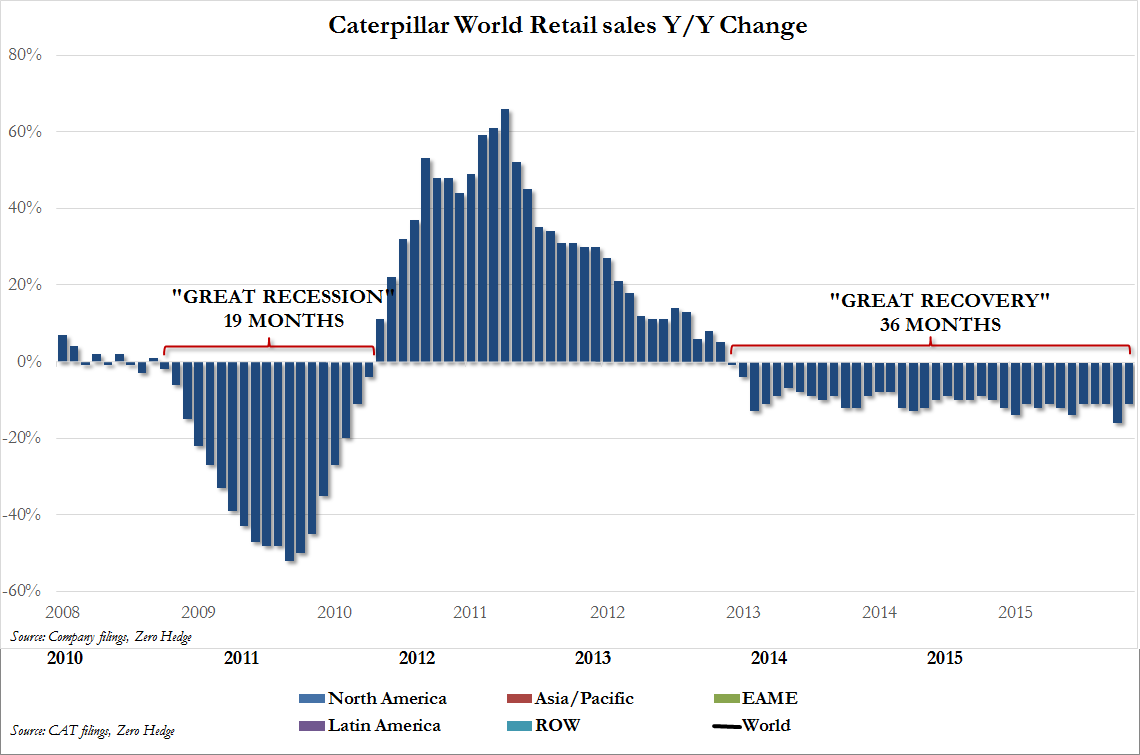

But what is more depressing is that as the chart below shows, for CAT the global manufacturing depression just turned 3 years old as the company has now suffered through 36 consecutive months of declining annual retail sales – something unprecedented in company history, and set to surpass the “only” 19 months of declining during the great financial crisis by a factor of two!

And as we have shown previously, with the market no longer rewarding stock buybacks, Caterpillar suddenly finds itself flailing in the gale strength winds of what nobody can claims any longer is not a global industrial depression.

However, there is good news – as we showed one month ago, while Caterpillar’s revenues and cash flows may be plummeting with every passing month, at least the company has a cunning plan how to recover some inventory.

According to the WSJ, Caterpillar is eager to reassure shareholders it won’t get burned on equipment leased to customers in China even as the economy cools there. CAT Financial Services President Kent Adams said during a conference call on Tuesday that the company keeps tabs on the position of machinery electronically through its Product Link system.

“If a customer falls behind, we have the ability to derate the engine or turn the engine off, and we’ve set up a legal presence in all of the provinces of China.”

In other words, any and all Chinese lessors who fall behind on their payments will suddenly find their excavator’s engine shut down and no longer operable, stuck in the middle of a mine, quarry, or construction site with a paperweight weighing dozens of tons.

Leave A Comment